Advertisement|Remove ads.

FactSet Stock Rises On $246.5M Acquisition Of LiquidityBook: Retail Enthusiasm Soars

Shares of financial digital platform FactSet Research Systems Inc (FDS) traded over 1% higher in Monday’s pre-market session after the company announced the acquisition of cloud-native buy- and sell-side trading solutions provider LiquidityBook for a gross purchase price of $246.5 million in cash.

FactSet said the acquisition closed on Feb. 7 and was funded by borrowings under its existing revolving credit facility.

The company expects the transaction to be modestly dilutive to its fiscal 2025 GAAP and adjusted diluted earnings per share (EPS).

LiquidityBook provides cloud-native trading solutions to hedge funds, asset and wealth management, outsourced trading, and sell-side middle office clients.

The company also operates a proprietary FIX (Financial Information eXchange) network that enables streamlined connectivity to over 200 brokers and order routing to more than 1,600 destinations across 80 markets globally.

FactSet and LiquidityBook have earlier partnered to enable a turnkey integration of the latter’s flagship order management system (OMS) into the FactSet Workstation.

Rob Robie, Executive Vice President and Head of Institutional Buy Side at FactSet, explained that clients want to spend their time on actionable investment decisions rather than jumping between disparate research, portfolio management, and trading platforms.

“Deeper integration of LiquidityBook’s OMS and IBOR into the FactSet Workstation will enable a consolidated front office solution that meets the increasingly sophisticated needs of our clients,” he said.

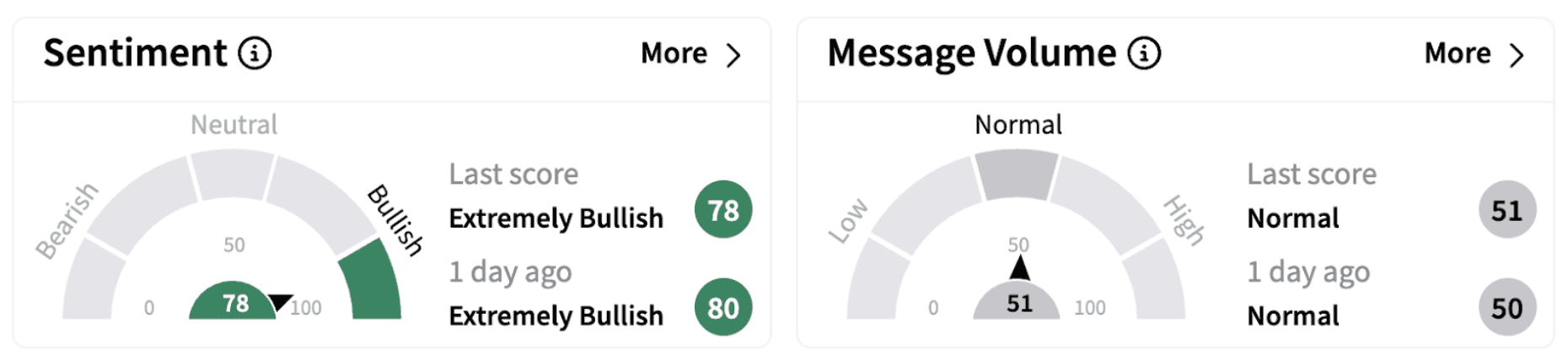

On Stocktwits, retail sentiment continued to trend in the ‘extremely bullish’ territory (78/100) on Monday morning.

FDS shares have lost over 2% in 2025 and are down nearly 1% over the past year.

Also See: Frontier Group Stock Scores Barclays Price Target Boost, Retail Optimism Stays High

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_stablecoin_rep_jpg_5ec196dfc2.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2228901342_jpg_7365e02c40.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_4530_jpeg_a09abb56e6.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2218742693_jpg_8d1b39840a.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_8805_JPG_6768aaedc3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2195880631_jpg_5d50833996.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/IMG_9209_1_d9c1acde92.jpeg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2227553102_jpg_9cb79c1b5b.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2236688965_jpg_b00d009983.webp)