Advertisement|Remove ads.

Frontier Group Stock Scores Barclays Price Target Boost, Retail Optimism Stays High

Frontier Group Holdings Inc (ULCC) shares received a price target hike by Barclays on Monday after the company reported a better-than-expected fourth-quarter earnings report.

According to The Fly, Barclays raised its price target on Frontier Group to $14 from $10 while keeping an ‘Overweight’ rating on the shares. The new price target implies a 50% upside from the stock’s closing price on Friday.

The brokerage highlighted that Frontier’s stronger unit revenue performance aids a more bullish margin outlook for 2025. Barclays also noted that although the management remains interested in a merger with Spirit, it maintains its focus on driving core earnings improvement.

On Friday, Frontier reported a 12% rise in its total operating revenue to a record billion dollars compared to a Wall Street estimate of $986.50 million. Adjusted earnings per share (EPS) came in at $0.23 compared to an analyst estimate of $0.13.

Net income for the quarter was $54 million, compared to a net loss of $37 million in the same quarter a year ago.

Revenue per available seat mile (RASM) rose 15% year-over-year (YoY) to $0.1023 during the quarter. The firm said this was primarily driven by its capacity deployment focused on peak days of the week, continued progress on the revenue and network initiatives, and the overall moderation in industry capacity growth.

CEO Barry Biffle said in an interview with CNBC that the premiumization and the focus on loyalty are starting to take effect. “That enabled us to exceed expectations in the fourth quarter,” he said.

In late January, Spirit Airlines Inc (SAVEQ) had rejected Frontier's new merger offer.

Frontier’s proposal involved combining with Spirit in a transaction that provides for the issuance of $400 million principal amount of debt by the firm and 19% of its common equity at the closing of the transaction, to be distributed to the holders of senior secured notes, 2025 convertible notes, 2026 convertible notes, and existing interests.

Biffle also stated that with Spirit extending its deadline for the rights offering by a week, Frontier remains ready to engage.

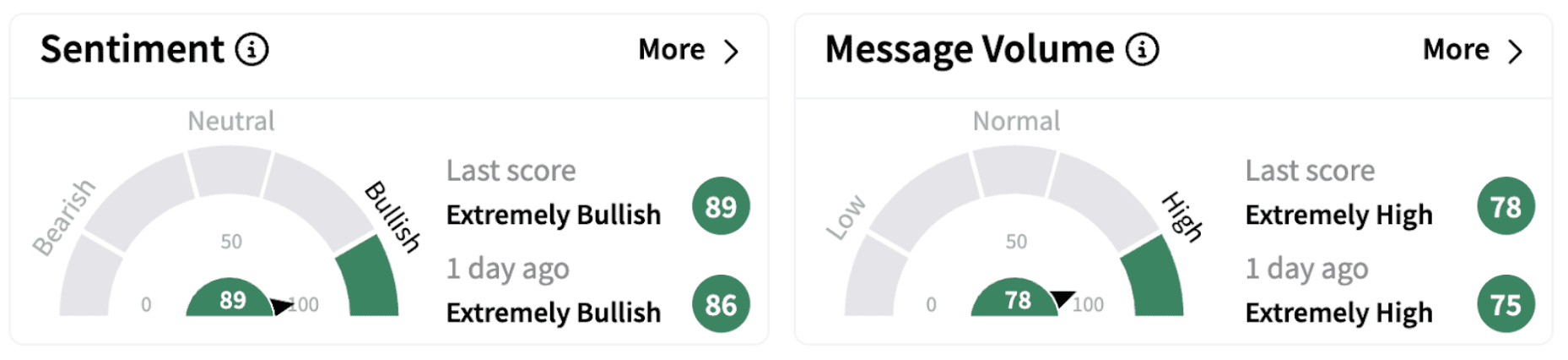

On Stocktwits, retail sentiment climbed further into the ‘extremely bullish’ territory (89/100), accompanied by significant retail chatter.

Frontier Group shares traded marginally in the green in Monday’s pre-market session after closing over 15% higher on Friday.

ULCC shares have gained over 29% in 2025 and have risen over 18% in the last year.

Also See: IBEX Stock Soars On Record Revenue, Upbeat Guidance: Retail’s Yet To Be Convinced

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_tesla_fsd_jpg_f113fd1ea5.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_8805_JPG_6768aaedc3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Christopher_Giancarlo_OG_jpg_915015c289.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2227884296_jpg_f4ab8e4dcf.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/IMG_9209_1_d9c1acde92.jpeg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_hims_stock_logo_resized_jpg_5554a2a2c1.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_crypto_atm_OG_jpg_ab7e4567eb.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2235337353_jpg_bdb561432a.webp)