Advertisement|Remove ads.

Fed Meeting Today: Will The Central Bank Cut Interest Rates? Here's What Experts And Retail Users Think

The Federal Reserve’s crucial interest rate decision is scheduled to be announced on Wednesday at 2 p.m. ET. The Federal Open Market Committee’s (FOMC) meeting kicked off on Tuesday to review the latest economic data, and it will conclude on Wednesday.

Markets widely expect the central bank to cut the benchmark rate by 25 basis points – the CME FedWatch tool points to a 94% probability of a rate cut.

Boosting the hopes of a rate cut during the September meeting is a weak labor market and soft inflation – the consumer price index (CPI) rose 2.9% annually in August, in line with Wall Street expectations. Weekly jobless claims rose to their highest levels in almost four years, surpassing estimates.

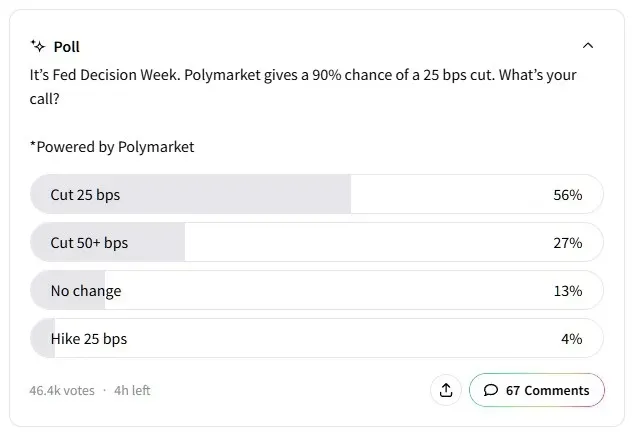

Retail users on Stocktwits widely expect the Fed to announce a rate cut on Wednesday, with 83% of respondents in an ongoing poll indicating that a 25-basis-point (bps) or 50-bps rate cut is possible. However, 13% of the respondents say there could be no rate cut, while 4% expect a 25 bps hike.

Morgan Stanley expects the Fed to announce four interest rate cuts between September and January. The firm stated in a recent note that the central bank will aim to achieve neutral policy rates “more decisively” before pausing to assess the impact of its rate cuts.

On Tuesday, President Trump stated that while the Fed should be independent, it should also listen to “smart people” like himself. “If you look, all the economists got it wrong, I got it right along with some other people out of a hundred. So they should listen to people that are smart, there’s nothing wrong with that, but they have to make their own choice. But they should listen,” Trump told reporters at the White House.

Meanwhile, U.S. equities edged lower in Wednesday’s opening trade. At the time of writing, the SPDR S&P 500 ETF (SPY), which tracks the S&P 500 index, was down 0.12%, while the Invesco QQQ Trust (QQQ) fell 0.4%. Retail sentiment around the S&P 500 ETF on Stocktwits was in the ‘bullish’ territory.

The iShares 7-10 Year Treasury Bond ETF (IEF) was up 0.02% at the time of writing.

Also See: Trump Says Fed Should Be Independent, But Adds It ‘Should Listen To Smart People Like Me’

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1549425533_jpg_483afd6d69.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_stock_down_resized_901c19c371.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2235778544_jpg_2b7ceca102.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_hawaiian_electric_resized_4b766fd741.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_sealsq_stock_market_representative_resized_b05435011f.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2230137825_jpg_d14459f501.webp)