Advertisement|Remove ads.

FedEx Gets A Price Target Cut From JPMorgan Ahead Of Q3 Earnings: Retail Remains Skeptical

Logistics major FedEx Corp (FDX) was in the limelight on Monday after JPMorgan lowered its price target on the stock to $323 from $372 while keeping an ‘Overweight’ rating ahead of the release of the fiscal third-quarter report.

According to TheFly, JPMorgan is taking a "neutral stance" on FedEx as it does not anticipate a material update for the spin-off of FedEx Freight. The brokerage believes the quarterly report should largely meet expectations.

In December 2024, the company announced its intent to fully separate its FedEx Freight business. The company had highlighted that separating the Freight unit will enhance operational focus and strategic execution, and separate public stock listings will boost each company’s value proposition.

CEO Raj Subramaniam had called it the right time to pursue a separation. “Through this process, we will unlock value for our Freight business and position FedEx to create even greater value for stockholders,” he said.

Meanwhile, JPMorgan also noted that the "persistent uncertainty" from tariffs will likely push FedEx's fiscal 2025 earnings per share (EPS) guidance to the low end of the previous $19-$20 range.

The logistics player is scheduled to report its earnings after the closing bell on March 20. According to FinChat data, Wall Street expects the company to report EPS of $4.7 on revenue of $21.96 billion.

For the second quarter, FedEx announced revenue of $22 billion, compared to $22.2 billion in the same quarter a year ago and a Wall Street estimate of $22.09 billion. EPS came in at $4.05, compared to an analyst estimate of $3.93.

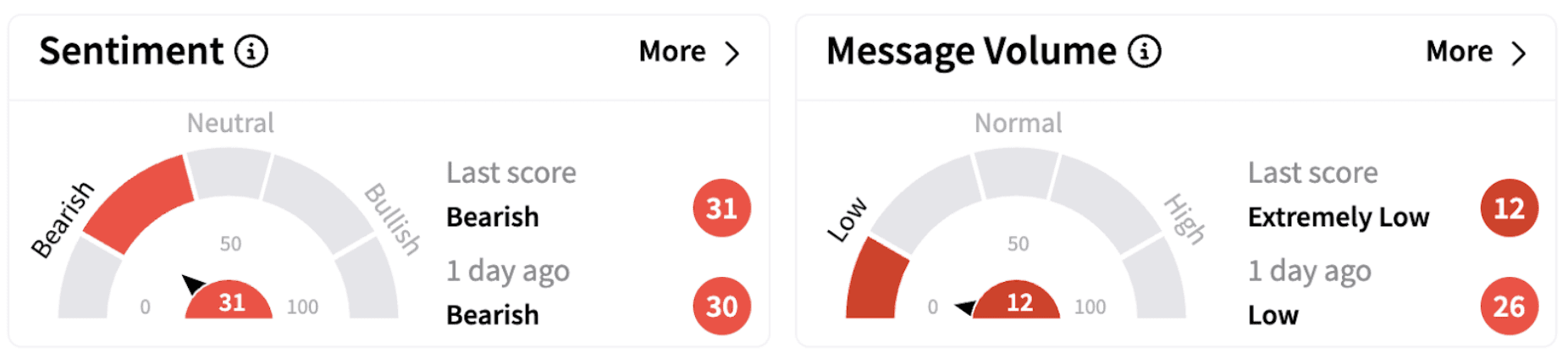

On Stocktwits, retail sentiment improved marginally but continued to trend in the ‘bearish’ territory (31/100) on Monday morning.

FedEx shares have lost over 4% in 2025 but have risen over 6% in the past year.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_opendoor_OG_jpg_55300f4def.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2243334218_jpg_b1b7c1b222.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Johnson_and_Johnson_jpg_bc42927ca0.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2207639540_jpg_4ae2641504.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Jamie_Dimon_July_736ff90d31.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2250241035_jpg_937df85f43.webp)