Advertisement|Remove ads.

Fed’s Lone Dissenter Michelle Bowman Still Worried About Inflation, Says Colleagues Should Have Taken ‘Measured Approach’

Federal Reserve Governor Michelle Bowman, who was the lone dissenter at the Federal Open Market Committee’s latest policy meet, reportedly stated that she is concerned about inflation and her colleagues should have taken a more measured approach to the 50 basis points rate cut.

Bowman believes the half-percentage-point rate cut may not be conducive to the central bank’s goals of low inflation and full employment.

The massive rate reduction “could be interpreted as a premature declaration of victory on our price-stability mandate. Accomplishing our mission of returning to low and stable inflation at our 2% goal is necessary to foster a strong labor market and an economy that works for everyone in the longer term,” Bowman told a bankers group in Kentucky, according to CNBC.

Last week, the rate setting committee noted it has “gained greater confidence that inflation is moving sustainably toward 2%, and judges that the risks to achieving its employment and inflation goals are roughly in balance.” The economic outlook is uncertain, and the committee is attentive to the risks to both sides of its dual mandate, it said.

Bowman was in favor of reducing rates but preferred a 25 basis points reduction against a jumbo 50 bps cut in one go. “In light of these considerations, I believe that, by moving at a measured pace toward a more neutral policy stance, we will be better positioned to achieve further progress in bringing inflation down to our 2 percent target, while closely watching the evolution of labor market conditions,” Bowman said.

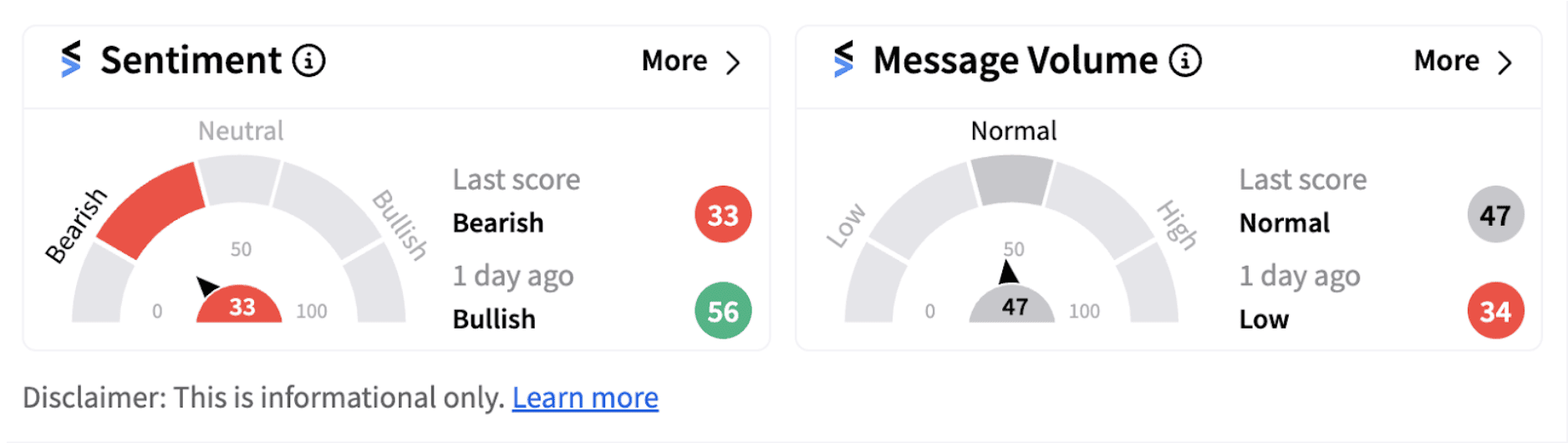

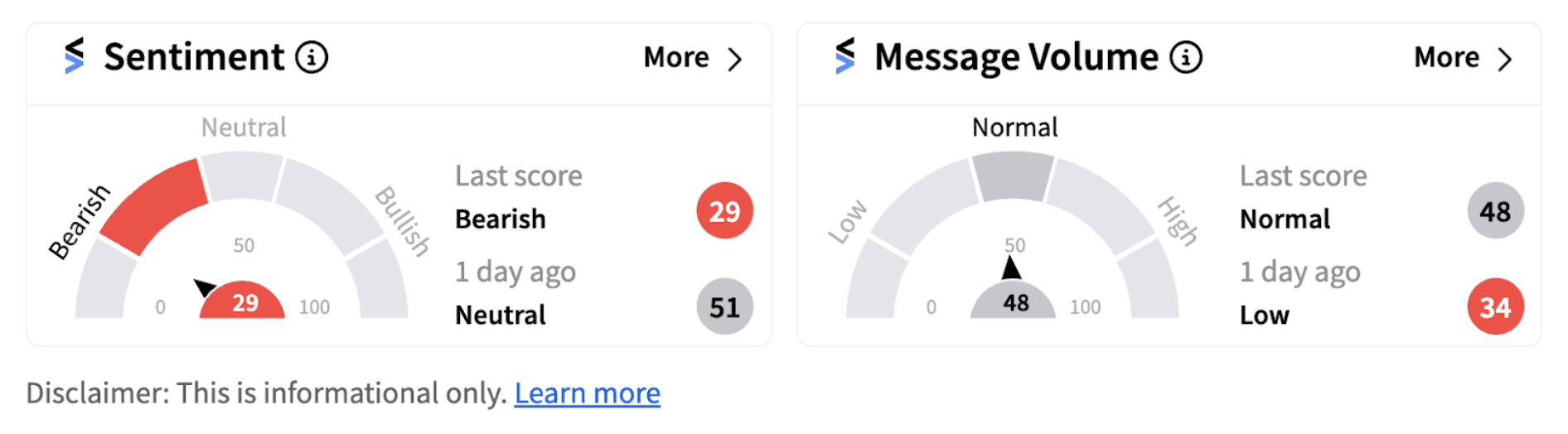

Major Wall Street indices have rallied nearly 2 % since the Fed’s policy decision. However, investors are beginning to get jittery about the market’s record high levels with sentiment meters of two of the most popular ETFs – SPDR S&P 500 ETF Trust and Invesco QQQ Trust, Series 1 – dipping into the ‘bearish’ territory.

Despite the massive rate reduction, there’s talk that the Fed might have acted too late in avoiding a potential recession. Some Stocktwits users are expressing concerns about a possible contraction in the economy in the coming times.

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2210782188_jpg_62a7577b80.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/vivekkrishnanphotography_58_jpg_0e45f66a62.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2203138957_jpg_dd735f9905.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Rounak_Author_Image_7607005b05.png)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Applied_materials_resized_jpg_a4b6b7fe3a.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_penumbra_jpg_62627929c6.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2241256389_jpg_227f35a9db.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_SNDK_jpg_64ec2f12fb.webp)