Advertisement|Remove ads.

Femasys Stock Sparks Retail Frenzy After FDA Clears Final Phase Of FemBloc Trial And $58M Financing

- Femasys secured FDA approval to proceed with the final phase of its pivotal FemBloc trial, a key step toward U.S. market approval for its non-surgical permanent birth control device.

- The company raised $12 million through convertible notes, with potential total proceeds of $58 million if all warrants are exercised, strengthening its balance sheet.

- Retail investors on Stocktwits turned bullish on the news, calling Femasys a long-term play with disruptive potential in women’s health.

Retail chatter around Femasys spiked on Monday following the company’s announcement that it secured U.S. Food and Drug Administration (FDA) approval to advance the final phase of its pivotal trial for FemBloc, a non-surgical permanent birth control device, and raised $12 million in financing that could grow to $58 million if all warrants are exercised.

FDA Clears Final Phase Of FemBloc Trial

Femasys announced FDA approval to resume enrollment for the final phase of the FemBloc pivotal FINALE trial, allowing it to move closer to U.S. Pre-Market Approval (PMA).

The Investigational Device Exemption (IDE) approval came following the successful completion of the trial’s first stage, advancing the commercialization of the world’s first non-surgical, permanent birth control in the U.S.

FemBloc uses a polymer-based delivery system that blocks the fallopian tubes without incisions or anesthesia, offering a safer and lower-cost alternative to surgical sterilization.

Financing Deal With Potential Upside To $58 Million

Alongside the FDA update, Femasys entered into a private placement agreement with institutional and accredited investors, led by Jorey Chernett, to issue $12 million in senior secured convertible notes and warrants, with the potential to raise total proceeds to $58 million if exercised for cash.

The company said proceeds will go toward refinancing debt and advancing the commercialization of its fertility and permanent birth control portfolio.

The notes carry an 8.5% annual interest rate and are convertible at $0.73 per share, a 15% premium to the stock’s prior closing price. Warrants carry exercise prices between $0.81 and $1.10 per share, with 10-year terms.

Stocktwits Users Cheer Regulatory Win

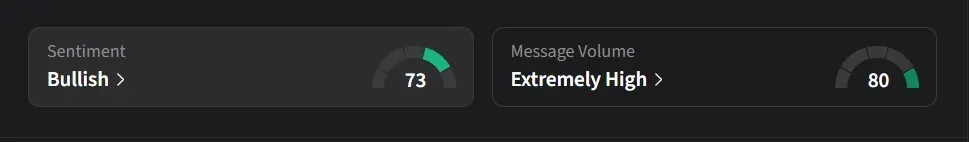

On Stocktwits, retail sentiment for Femasys was ‘bullish’ amid ‘extremely high’ message volume.

One user said they viewed Femasys as a long-term play, describing its regulatory progress and disruptive women’s health products as strong growth drivers. The user added that the company’s performance is likely to move “based on fundamentals” rather than hype, noting that women’s health remains an underappreciated sector.

Another user speculated whether the stock would see after-hours upside following the positive news.

Femasys’ stock has declined 40% so far in 2025.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2262920033_jpg_f596c67fd3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2231498932_jpg_bdd44fc548.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2233516954_jpg_72241a7246.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_AEHR_chip_maker_3698bf2343.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Trending_stock_resized_may_jpg_bc23339ae7.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/vivekkrishnanphotography_58_jpg_0e45f66a62.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2205870269_jpg_b38339787f.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/shivani_photo_jpg_dd6e01afa4.webp)