Advertisement|Remove ads.

FIS Stock Gets Barrage Of Price Target Cuts After Q4 Earnings Report: But Retail Looks The Other Way

Shares of FIS traded over a percent lower in Wednesday’s pre-market session after the stock received a barrage of price target cuts and a downgrade following its fourth-quarter earnings report.

According to The Fly, Susquehanna downgraded FIS to ‘Neutral’ from ‘Positive’ and reduced the price target to $81 from $103.

According to the brokerage, it is unclear if and when the company’s management can get "back on track” in a tough end market with uneven bank IT budgets. FIS appears to be encountering several free cash flow challenges, the analyst said, adding that the company "needs time to reconfigure.”

Meanwhile, Wells Fargo lowered the firm's price target to $80 from $88 while keeping an ‘Equal Weight’ rating on the shares. The firm noted that while Capital Markets sustained its momentum, Banking lagged on multiple one-time headwinds.

Wells also believes investors will come away justifiably skeptical of FIS's ability to deliver the second half of the year acceleration implied by guidance.

During the fourth quarter, FIS’ revenue rose 3% year-over-year (YoY) to $2.59 billion, below an analyst estimate of $2.63 billion. Adjusted earnings per share (EPS) came in at $1.4, beating a Street forecast of $1.36.

Adjusted net earnings rose 36% YoY to $754 million.

For the first quarter, the firm expects revenue of $2.485 billion-$2.510 billion, which falls short of an analyst estimate of $2.568 billion. Adjusted EPS is expected to come in at $1.17-$1.22, lower than a Street estimate of $1.36.

Following the earnings report, FIS shares closed over 11% lower on Tuesday, registering their worst single-day performance since March 13, 2023.

Other analysts, too, have trimmed their price targets on the stock. While Baird lowered the firm's price target to $80 from $88, Stephens lowered its price target to $90 from $100.

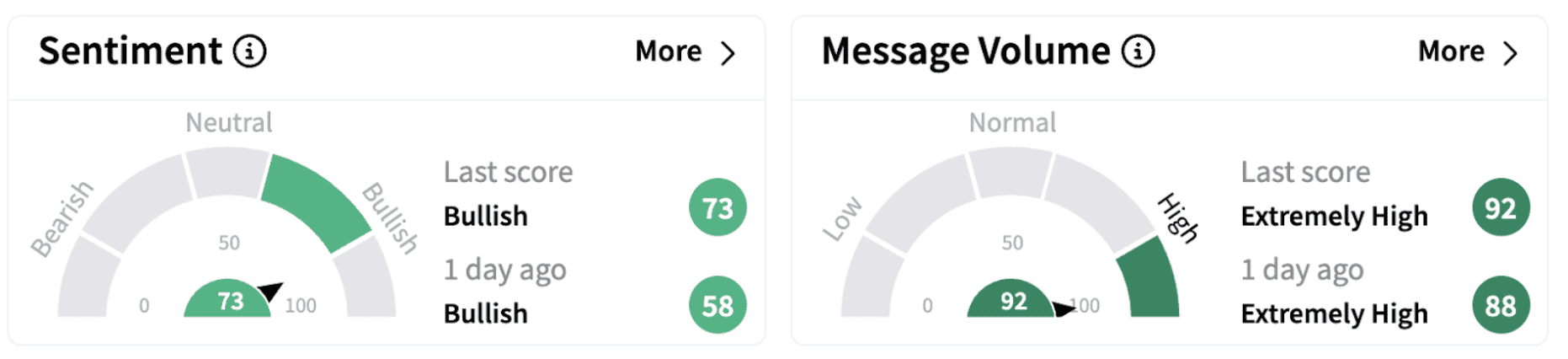

On Stocktwits, retail sentiment climbed further into the ‘bullish’ territory (73/100) accompanied by significantly high retail chatter that hit a year-high level.

FIS shares have lost over 8% in 2025 and have gained over 17% over the past year.

Also See: CME Group Stock In Spotlight After Q4 Revenue Beat: Retail Sentiment Brightens

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_HPE_office_with_logo_resized_c15b2ba0d3.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_stock_market_fall_generic_jpg_f7dffafa95.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2219201937_jpg_67aaff68c1.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2213366819_jpg_3e8b649e98.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1445160636_jpg_9759816169.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_stock_price_rising_OG_jpg_5f141f956f.webp)