Advertisement|Remove ads.

Fiserv Q3 Earnings Preview: Spending Trends In Focus, Analysts Warn Of Lower Sales Forecast

- A majority of analysts expect the firm to lower its organic sales forecast amid heightened competition in the payments space.

- Mizuho analysts reportedly stated that the company's organic sales forecast of 10% was "overly optimistic."

- The company has topped estimates in all four previous quarters.

Fiserv stock gained over 2% in premarket trading on Wednesday ahead of its third-quarter earnings report.

According to Fiscal.ai data, Wall Street expects the fintech firm to post earnings of $2.65 per share on revenue of $5.35 billion. The company has topped estimates in all four previous quarters.

What Are Analysts Saying?

A majority of analysts expect the firm to lower its organic sales forecast amid heightened competition in the payments space. According to TheFly, Mizuho analysts stated that the company's organic sales forecast of 10% was "overly optimistic." The brokerage also reportedly noted that Fiserv is likely to fall short of the prior guidance.

However, the analysts stated that while the near-term expectations are likely too high for Fiserv, the company's medium-term fundamentals "remain sound.”

In a broader sector note, Truist analysts reportedly said forecasts for certain firms may come in worse than Wall Street’s expectations following the strong holiday spending season last year. The firm, however, noted that third-quarter spending has held up well.

Fiserv helps clients with account processing, digital banking, and payments, including credit and debit card processing, merchant acquiring, and e-commerce solutions. Earlier this month, American Express raised the lower end of its forecast amid higher spending among affluent customers, especially in luxury purchases and travel.

What Is Retail Thinking?

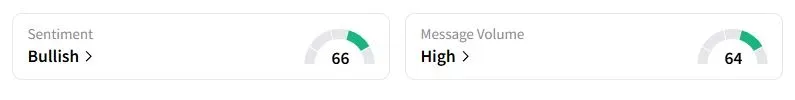

Retail sentiment on Stocktwits about Fiserv was in the ‘bullish’ territory at the time of writing.

One trader expected the stock to hit as high as $140.

Fiserv's stock has fallen 37% this year, amid concerns about the growth of its payment processing platform, Clover, amid trade uncertainty induced by the Trump tariffs.

Also See: Why Is Bloom Energy Stock Surging Nearly 20% Premarket Today?

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_bitcoin_2026_OG_2_jpg_f92901a0f5.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2231786698_jpg_4d7b65921f.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_8805_JPG_6768aaedc3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Shift4_logo_jpg_jpg_1845f04c23.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_4530_jpeg_a09abb56e6.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Oil_drill_06147e8349.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Stock_chart_image_d3ebab70ec.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_ras_tanura_jpg_b79d6fe085.webp)