Advertisement|Remove ads.

Why Is Bloom Energy Stock Surging Nearly 20% Premarket Today?

- On an adjusted basis, the fuel cell maker reported earnings of $0.15 per share for the three months ended Sept. 30, while analysts expected $0.10 per share.

- The company said its gross margin stood at 29.2% in the third quarter, compared to 23.8% a year earlier.

- “We expect fiscal 2025 to be better than our previously stated annual guidance on our financial metric.” — CFO Maciej Kurzymski.

Bloom Energy stock (BE) jumped over 19% in premarket trading on Wednesday after the firm sailed past Wall Street’s estimates for third-quarter profit.

On an adjusted basis, the fuel cell maker reported earnings of $0.15 per share for the three months ended Sept. 30, while analysts expected $0.10 per share. Its revenue of $519 million also topped estimates of $428.1 million.

What Is Driving The Gains?

Fuel cell makers such as Bloom Energy have benefited from the surge in global demand for AI power. The U.S. Energy Information Administration projects that U.S. power demand will set new records in both 2025 and 2026, further straining the grid. Large-scale developers are now seeking off-grid power solutions, such as fuel cells, to maintain a reliable power supply for data centers.

“Bloom is at the center of a once-in-a-generation opportunity to redefine how power is generated and delivered,” CEO KR Sridhar said. “Powerful tailwinds—surging demand for electricity driven by AI, nation-state priorities, and our relentless pace of innovation—are converging to accelerate our audacious journey to becoming a standard for onsite power globally.”

Bloom Energy has already inked agreements with American Electric Power, Brookfield Asset Management, and Oracle. The company said its gross margin stood at 29.2% in the third quarter, compared to 23.8% a year earlier.

“We expect fiscal 2025 to be better than our previously stated annual guidance on our financial metric,” said Chief Financial Officer Maciej Kurzymski. The company had already projected doubling its capacity to over 2 gigawatts, which could help it quadruple its revenue in 2026.

What Is Retail Thinking?

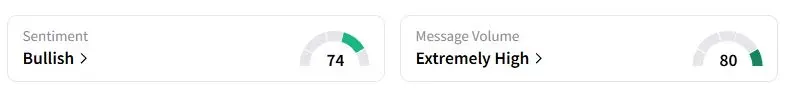

Retail sentiment on Stocktwits about Bloom Energy was in the ‘extremely bullish’ territory at the time of writing.

One retail trader wondered if the stock would open at $150 on Wednesday.

“The shorts are in real pain. This could turn into an epic squeeze [in] the coming days,” another trader said.

The stock has risen over fivefold this year.

Also See: Why Is Enphase Stock Falling Over 9% Premarket?

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1710397990_jpg_c2ac3394d9.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_4530_jpeg_a09abb56e6.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2244297865_jpg_34f8b38611.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_8805_JPG_6768aaedc3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_circle_stablecoins_original_jpg_b238d12be8.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2249860620_jpg_2bd9e54f08.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_bitcoin_2026_OG_2_jpg_f92901a0f5.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2231786698_jpg_4d7b65921f.webp)