Advertisement|Remove ads.

Five Below Raises FY25 Forecast After Strong Q1: Retail Optimism Improves

Discount retailer Five Below Inc. (FIVE) bumped its annual forecast after a strong quarterly report on Wednesday, driving its shares and retail sentiment higher.

The retailer, which sells trendy products for $5 or less, targeting teens and tweens, gained from a "trend-right product" strategy and store expansion.

Five Below increased its 2025 revenue projection to a range of $4.33 billion to $4.42 billion from $4.21 billion to $4.33 billion previously. It also raised the lower end of its adjusted earnings per share (EPS) guidance to $4.25 from $4.10, while maintaining the upper end at $4.72.

The forecast assumes the opening of 30 new stores and an approximate 7% to 9% increase in comparable sales.

For the first quarter, which ended on May 5, net revenue increased to $970.5 million from $811.9 million last year, and adjusted earnings to $0.86 per share from $0.60.

Analysts were expecting $966.5 million in revenue and EPS of $0.83, according to estimates from FactSet.

The company opened 55 new stores in the quarter, taking the total count 15% higher to 1,826.

"Our first quarter results demonstrate the effectiveness of our strategy, grounded in trend-right product, extreme value and a fun store experience,” CEO Winnie Park said.

Separately, Five Below announced that Chief Financial Officer Kristy Chipman will step down for personal reasons, and Chief Operating Officer Ken Bull will assume her duties temporarily.

Shares gained 4.6% in extended trading on Wednesday.

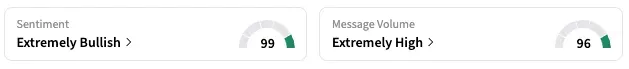

On Stocktwits, the retail sentiment climbed higher in the 'extremely bullish' territory.

A user said that Five Below's strategy to advertise through social media creators instead of heavy spending on marketing was bearing results.

Five Below shares are up 15.5% this year.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_LUNR_Intuitive_Machines_resized_jpg_5655032711.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/vivekkrishnanphotography_58_jpg_0e45f66a62.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_stock_chart_falling_resized_jpg_c0ce61eff2.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Rounak_Author_Image_7607005b05.png)

/filters:format(webp)https://news.stocktwits-cdn.com/large_MSTR_caaa0be909.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1903197985_jpg_2c45018acb.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/shivani_photo_jpg_dd6e01afa4.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Trending_stock_resized_may_jpg_bc23339ae7.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2203138957_jpg_dd735f9905.webp)