Advertisement|Remove ads.

Flywire Stock Gets A Price Target Cut From JPMorgan After Q4 Sales Miss: Retail Plays Contrarian

Payments enabler Flywire Corporation (FYLW) stock drew retail attention on Thursday after JPMorgan lowered its price target on the stock to $16 from $21 while keeping a ‘Neutral’ rating.

According to TheFly, JPMorgan noted that more education visa headwinds emerged to drive a fourth-quarter (Q4) sales miss.

Flywire shares closed over 37% lower on Wednesday after the company’s fourth-quarter losses disappointed investors. This was the stock’s worst single-day performance since at least January 2022, according to Koyfin data.

Revenue rose 17% to $117.6 million in the fourth quarter but fell short of a Wall Street estimate of $118.85 million. The company reported an earnings loss of $0.12 compared to an estimated earnings per share of $0.13, according to FinChat.

Net loss stood at $15.9 million, compared to a net income of $1.3 million in the fourth quarter of 2023.

Despite the negative earnings report, the company’s Total Payment Volume jumped 27.6% to $6.9 billion, compared to $5.4 billion in the fourth quarter of 2023. The number of clients grew by 16% year over year, with over 180 new clients added in the fourth quarter.

CEO Mike Massaro noted that the company will undertake an operational and business portfolio review.

“One of the efficiency measures we are undertaking is a restructuring, which impacts approximately 10% of our workforce. It is difficult to say goodbye to so many FlyMates, and I want to thank them for their hard work as we endeavor to support them throughout this transition.”

For the first quarter of 2025, Flywire expects FX-neutral GAAP revenue growth at 10-13% YoY while adjusted earnings before interest, tax, depreciation, and amortization (EBITDA) growth of over 300-600 basis points YoY.

For 2025, the company projected FX-neutral GAAP revenue growth at 9-13% YoY and adjusted EBITDA margin growth at over 200 to 400 bps YoY.

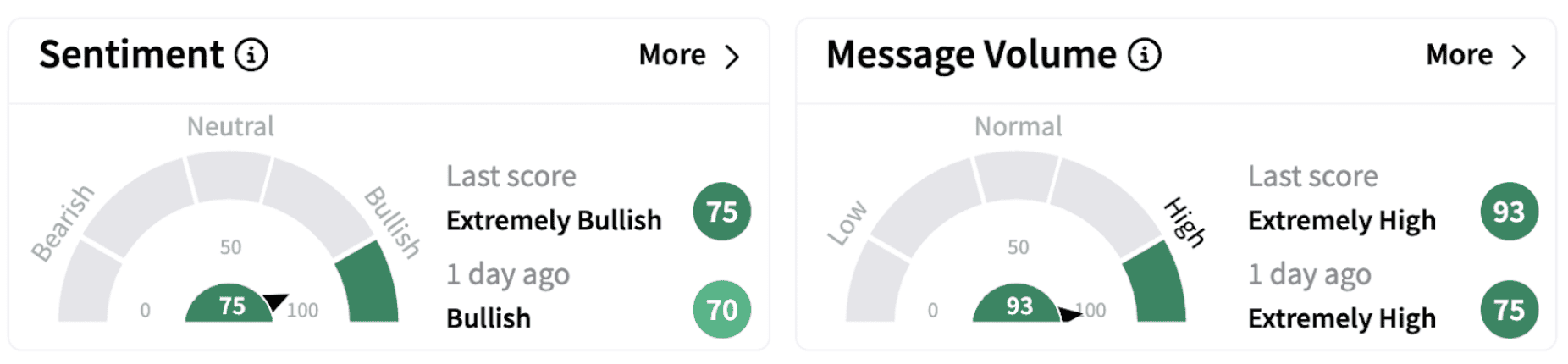

Meanwhile, on Stocktwits, retail sentiment jumped into the ‘extremely bullish’ territory (75/100), accompanied by significant retail chatter.

FYLW shares have lost over 45% in 2025 and are down nearly 55% over the past year.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2231786698_jpg_4d7b65921f.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_8805_JPG_6768aaedc3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Shift4_logo_jpg_jpg_1845f04c23.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_4530_jpeg_a09abb56e6.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Oil_drill_06147e8349.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Stock_chart_image_d3ebab70ec.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_ras_tanura_jpg_b79d6fe085.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2202580632_jpg_9b97227b1a.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)