Advertisement|Remove ads.

Unum Stock Rises Pre-Market After $3.4B Long-Term Care Reinsurance Deal With Fortitude Re: Retail’s Yet To Be Impressed

Shares of Unum Group (UNM) rose nearly 2% in Thursday’s pre-market session after announcing a $3.4 billion long-term care reinsurance transaction with Fortitude Reinsurance Company.

Unum said that its subsidiary Unum America will cede, on a coinsurance basis, individual long-term care (LTC) insurance policies representing 19% of its total LTC block and a quota share of individual disability insurance (IDI) policies reinsured from an affiliate to Fortitude, effective Jan. 1, 2025. The quota share represents 20% of Unum's total in-force IDI premium.

Once the deal is closed, Unum America will cede $3.4 billion of individual LTC reserves and approximately $120 million of IDI in-force premium to Fortitude Re.

Fortitude will then retrocede biometric risk to a “highly rated global reinsurer.”

Unum said that the IDI portion of the transaction comprises business reinsured by an affiliate, Provident Life and Accident Insurance Company, and will not include new business going forward.

The deal is expected to generate a $100 million capital benefit, comprising a $200 million capital impact related to the reinsured LTC block and a $300 million capital benefit related to the reinsured IDI block.

CEO Richard P. McKenney said the transaction aligns with the company’s strategy of growing a leading employee benefits business while reducing its exposure to the legacy long-term care business. “Through this action, we further improve our risk profile, decrease the footprint of the closed block, and shift focus towards our more capital-efficient, higher-returning core businesses,” he said.

Unum has been in the news lately after its board of directors approved a share repurchase program of up to $1 billion of its common stock beginning on April 1, 2025.

In early February, the company reported its fourth-quarter (Q4) earnings with revenue rising 3% year-over-year (YoY) to $3.24 billion. Net income rose 5.5% to $348.7 million during the quarter.

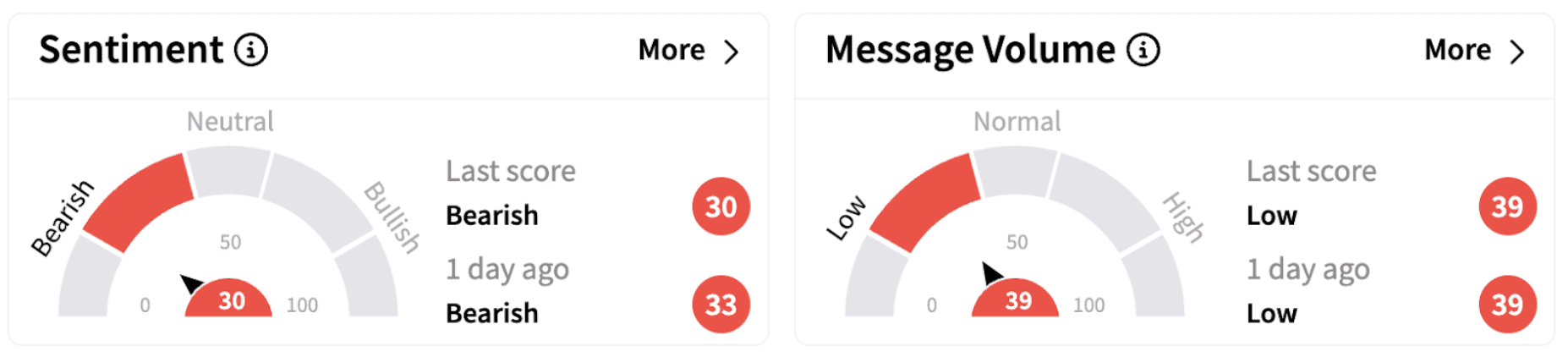

Meanwhile, on Stocktwits, retail sentiment dipped further into the ‘bearish’ territory (30/100).

Unum shares have risen 6% in 2025 and 57% over the past year.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2166957713_jpg_a9ada70a7b.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/shivani_photo_jpg_dd6e01afa4.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2227231024_jpg_227a7ced1a.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Michael_Bury_resized_jpg_14e6fc7c2b.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Rounak_Author_Image_7607005b05.png)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Trade_Desk_jpg_e7ed8e2266.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_ionq_resized_jpg_35563ea1fb.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Trending_stock_resized_may_jpg_bc23339ae7.webp)