Advertisement|Remove ads.

Foot Locker Stock Rises On Q4 Earnings Beat And Comparable Sales Growth, But Retail’s Downbeat

Shares of Foot Locker Inc. (FL) rose more than 5% on Wednesday after the footwear retailer reported earnings that topped expectations. However, revenue and guidance fell short of estimates, dragging down retail sentiment.

Fourth quarter sales missed estimates, coming in at $2.24 billion, declining 5.8% year-over-year. Earnings per share (EPS) stood at $0.86, beating estimates of $0.72.

However, comparable sales went up 2.6% year-over-year, with the company noting that Champs Sports delivered its second consecutive quarter of comparable sales growth with gains of 1.8%.

Foot Locker sees FY25 EPS between $1.35 and $1.65, compared to the consensus estimate of $1.22. It projects FY25 revenue to decline 1% or increase up to 0.5%.

FY25 comparable sales are expected between 1% and 2.5%.

"Looking ahead, we will continue to prioritize our customer-facing investments, keep our inventories controlled, and manage our expense base with discipline to improve our profitability," said Foot Locker's president and CEO Mary Dillon.

"While we expect consumer and category promotional pressures to remain uncertain into 2025, especially within the first half, our Lace Up Plan strategies continue to resonate with our customers and brand partners."

Barclays lowered the firm's price target to $24 from $29 with an 'overweight' rating.

According to the report, Foot Lockers' Q4 results beat on comps, gross margin, operating margin, and earnings per share, though the high-end of FY25 guidance came in roughly 13% below consensus at the midpoint.

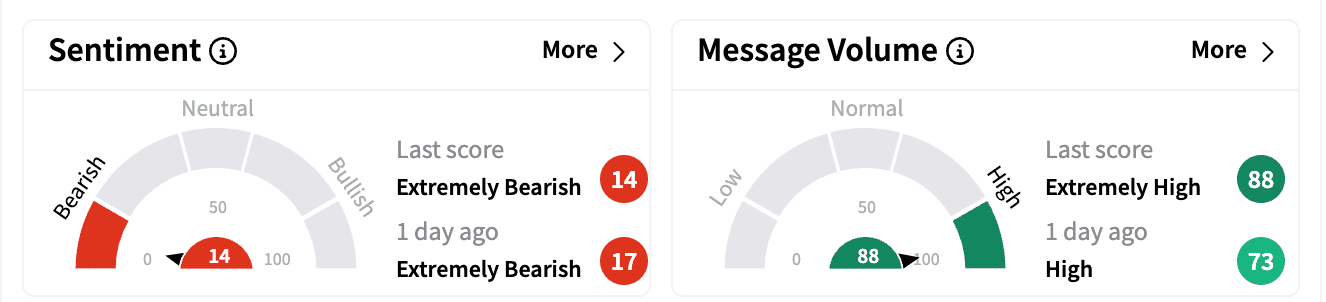

Sentiment on Stocktwits fell further in the 'extremely bearish' zone. Message volume rose to 'extremely high' from 'high.'

One bearish commenter flagged concerns about its sales performance.

As of Feb. 1, Foot Locker operated 2,410 stores in 26 countries.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_XRP_original_jpg_005097c9e8.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2261448901_jpg_dec7c2c9b9.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/IMG_9209_1_d9c1acde92.jpeg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_patrick_soon_shiong_jpg_32b8924ac2.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_8805_JPG_6768aaedc3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_bitcoin_OG_3_jpg_94334765ec.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Michael_Bury_resized_jpg_14e6fc7c2b.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2203271662_jpg_17b2d32174.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_4530_jpeg_a09abb56e6.webp)