Advertisement|Remove ads.

Ford Stock Eyes Another Day In The Red: Retail Stays Bullish, CEO Calls Out Trump Tariff 'Chaos'

Shares of Ford Motor Co. slipped on Tuesday afternoon and are on track to lose over 9% in the last five sessions.

The stock has been under pressure after the company flagged uncertainty surrounding President Trump's proposed 25% tariffs on imports from Canada and Mexico.

CEO Jim Farley criticized the proposed tariffs at the Wolfe Research automotive conference in New York, stating they have led to "a lot of cost, a lot of chaos" rather than strengthening the U.S. auto industry.

He also raised concerns about the potential impact of duties on goods from Mexico, set to take effect in March, calling them "devastating."

Farley and incoming CFO Sherry House further discussed the impact of Trump's steel and aluminum tariffs.

They noted that while Ford sources much of its materials domestically, some of its suppliers rely on foreign materials, which could increase costs.

Farley said he would travel to Washington, D.C., to meet with government officials about the potential hit from the proposed policy.

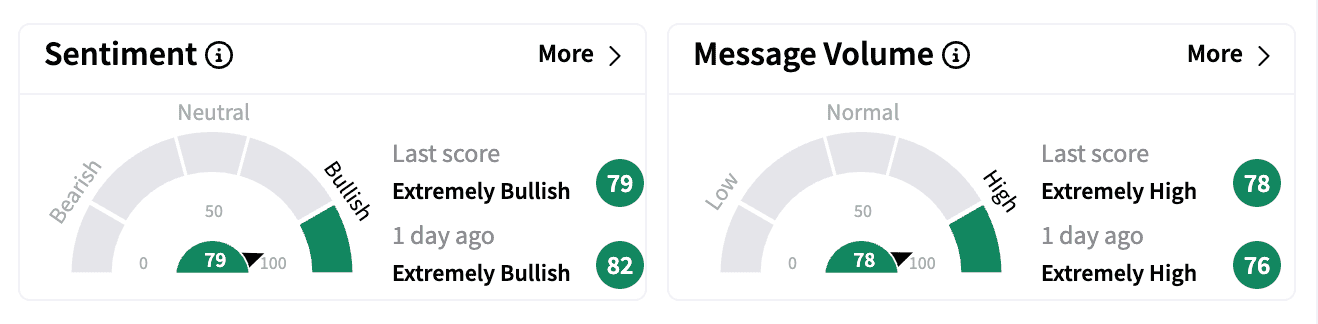

Despite the negative news, sentiment on Stocktwits remained 'extremely bullish' as retail investors appeared to buy the dip, with some discussing potential dividend plays.

The company announced a special dividend of $0.15 while reporting its fourth-quarter earnings.

At the start of last year, Ford paid a special dividend of $0.18; in 2023, it paid $0.65, according to Barron's.

Ford's stock has fallen more than 7% year-to-date and is down 27% over the past 12 months.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2242061511_jpg_742d610600.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/vivekkrishnanphotography_58_jpg_0e45f66a62.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_eli_lilly_hq_resized_af4cc05fd5.jpg)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Rounak_Author_Image_7607005b05.png)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2204154647_jpg_b295df5f6b.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/shivani_photo_jpg_dd6e01afa4.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_MSTR_caaa0be909.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_atomera_logo_resized_97a56614c5.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2250240969_jpg_dd9be8c5ea.webp)