Advertisement|Remove ads.

Ford Stock Tumbles On $2B Profit Hit Warning While Retail Finds Relief In Q4 Beat

Ford Motor Co. shares fell nearly 6% premarket Thursday, approaching lows last seen in January 2021 and tracking their worst session since late October.

Despite the decline, retail sentiment remained resilient as the automaker delivered a stronger-than-expected fourth-quarter (Q4) report.

Ford reported adjusted Q4 earnings per share (EPS) of $0.39, topping the $0.32 consensus estimate, while revenue surged to $48.2 billion, well ahead of the expected $42.83 billion.

Adjusted earnings before interest and tax (EBIT) reached $2.1 billion.

"Ford is becoming a fundamentally stronger company. We finished 2024 with a solid fourth quarter, capping the highest revenue year in Ford's history," said President and CEO Jim Farley. "Our product portfolio offers the broadest powertrain choice."

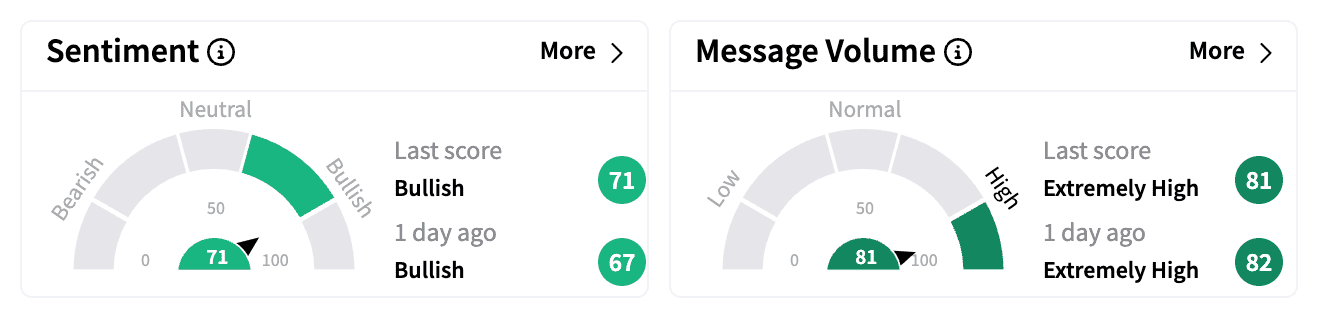

On Stocktwits, Ford was among the top five trending tickers before the bell, with sentiment remaining 'bullish' amid a surge in message volume.

Many retail investors cheered the earnings beat, hoping the stock would climb past $10 next week.

However, some bearish voices pointed to concerns over Ford's profit warning and the growing inaccessibility of affordable models.

Despite the Q4 beat, Ford issued a cautious 2025 outlook, projecting as much as $8.5 billion in adjusted EBIT, down from the $10.2 billion generated in 2024.

The company also expects first-quarter EBIT to be roughly breakeven, citing lower wholesales, an unfavorable vehicle mix, and major plant launch activities at Kentucky Truck and Michigan Assembly.

On the earnings call, Farley addressed the expected tariffs on Mexican and Canadian imports under President Donald Trump's administration, warning they could significantly impact the industry.

But he called out Toyota and Hyundai, noting that their vehicle imports from Japan and South Korea currently face little to no duties compared to the 25% tariff Trump has threatened on North American trade partners.

Ford expects $1 billion in cost reductions this year from lower warranty expenses and production costs, with adjusted EBIT anticipated to normalize by the second quarter.

The stock has dropped 14% over the past year and is up about 1% in 2025.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2242061511_jpg_742d610600.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/vivekkrishnanphotography_58_jpg_0e45f66a62.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_eli_lilly_hq_resized_af4cc05fd5.jpg)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Rounak_Author_Image_7607005b05.png)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2204154647_jpg_b295df5f6b.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/shivani_photo_jpg_dd6e01afa4.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_MSTR_caaa0be909.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_atomera_logo_resized_97a56614c5.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2250240969_jpg_dd9be8c5ea.webp)