Advertisement|Remove ads.

Detroit's 'Big Three' Auto Stocks Slide As Trump's Mexico, Canada Tariffs Kick In: Is Retail Feeling The Heat?

Shares of Ford Motor Co., General Motors, and Stellantis NV fell between 3% and 6% in early premarket trading Monday as President Donald Trump's administration rolled out hefty tariffs on imports from Canada and Mexico.

The 25% additional tariffs threaten auto production across North America. Bloomberg reported they could drive vehicle prices to record highs and disrupt nearly $250 billion in trade.

If pre-market losses hold, Ford and Stellantis shares could drop to three-week lows, while GM could sink to levels last seen nearly four months ago.

The Wall Street Journal, citing a Jefferies note, reported that GM assembles 63% of its North American vehicles in the U.S., compared to Ford's 83%.

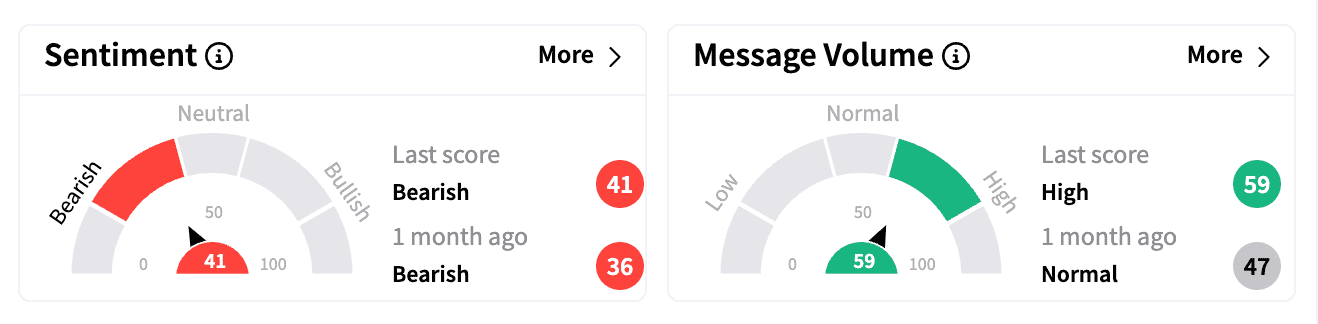

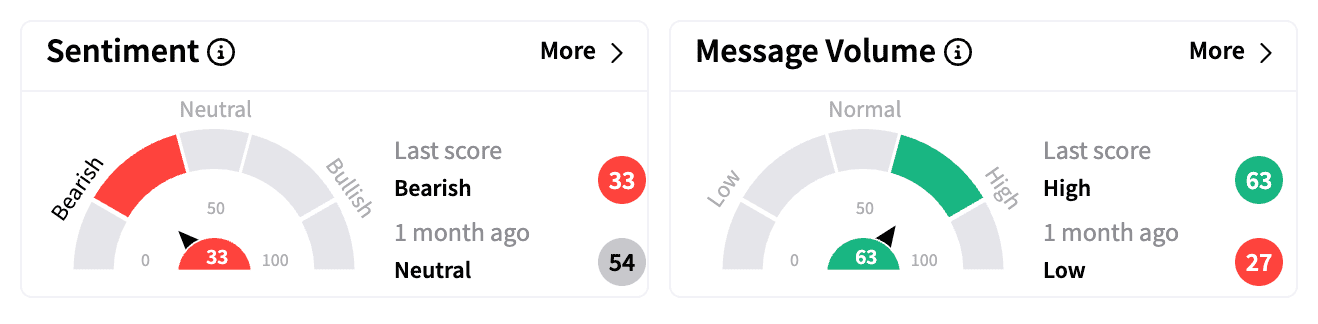

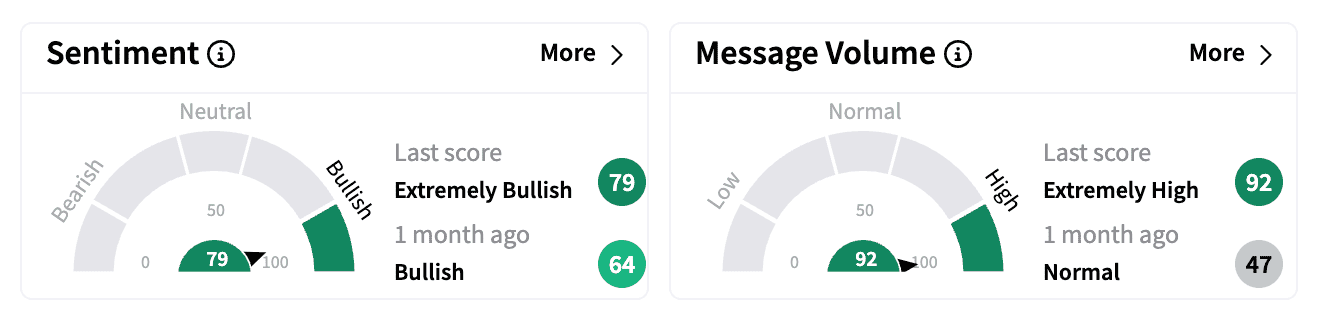

Retail sentiment on Stocktwits diverged ahead of the open, with Ford and Stellantis trending 'bearish,' while GM, surprisingly, had an 'extremely bullish' rating.

One Ford investor questioned whether the company would lose more money by paying the tariffs or trying to move all production into the United States.

A Stellantis watcher warned that Trump's tariffs would "grind NA auto production to a halt within a week."

Meanwhile, bullish GM posts highlighted strong fourth-quarter results and delivery figures, with some arguing the tariff impact was already priced in, making this a "buy the fear" moment.

According to MarketWatch, foreign carmakers face a similar challenge, with an average of 67% of their North American production in the U.S.

Meanwhile, Stellantis is undergoing another management shakeup, with Chief Software Officer Yves Bonnefont stepping down and Peugeot brand head Linda Jackson also losing her role, according to Bloomberg.

So far in 2025, Stellantis stock has risen by 1.3%, GM's has shed 7.2%, and Ford has gained 1.7%.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2254648547_jpg_a843db78b6.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1000648682_jpg_6aa61e3574.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2259602028_jpg_5b1a490e64.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2259775985_jpg_a06a1e88c3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_dogecoin_OG_2_jpg_304df31f25.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_vitalik_buterin_OG_jpg_7ac8ea93fe.webp)