Advertisement|Remove ads.

Hims & Hers Enters 2026 On Solid Ground — Stock Rises Even After Novo Nordisk Leaves It Off Wegovy Partner List

- Hims shares logged their best session in a month and added after-hours gains.

- Novo expanded oral Wegovy access, while Citi kept a ‘Sell’ rating on Hims.

- Hims continues to broaden its platform through international expansion and new services.

Hims & Hers Health Inc. shares posted their strongest session in a month on Monday and added another 0.7% in after-hours trading, with both trading days so far this year ending higher.

The move came despite a cautious note from Citi, which said Novo Nordisk’s latest Wegovy announcement could pressure Hims’ GLP-1 business in 2026. Citi kept a 'Sell' rating on the stock with a $30 price target.

Novo’s Oral Wegovy Move Leaves HIMS On The Sidelines

Novo Nordisk said on Monday that its oral Wegovy pill is now broadly available in the U.S., with pricing starting at $149 a month for specific doses and higher prices for larger doses later in 2026. Novo also said commercially insured patients could access the pill for as low as $25 per month.

Citi said Hims was again left off Novo’s list of partners, which includes CVS Health, Costco, LifeMD and GoodRx. The firm said this likely reflects disagreements between Novo and Hims around Hims’ compounded semaglutide strategy, and added that the broader rollout of Wegovy pills could put pressure on Hims’ GLP-1 business this year.

Broader Growth Drivers Remain in Focus

Hims & Hers Health has spent recent months expanding its platform beyond weight loss through geographic expansion, new product launches and acquisitions. In December, the company announced the expansion of its Weight Loss Program to the UK, including the official launch of the Hers platform for eligible women, offering access to weight-management care following assessments by GMC-registered doctors. The UK offering includes branded GLP-1 options and oral non-prescription treatments.

Hims has also entered Canada following the completion of its acquisition of Livewell, a Canadian digital health platform. Additionally, the company said it will acquire YourBio Health, which develops capillary whole blood sampling technology, including the TAP device that uses bladeless microneedles.

Separately, Hims launched its Labs in-depth testing experience, which provides customers with blood-based biomarker testing and doctor-developed action plans across areas such as heart health, metabolism, hormones and inflammation. The company said it plans to expand the Labs offering over time to include additional biomarker tests, at-home testing devices and advanced diagnostics.

In December, Barclays initiated coverage of Hims with an ‘Overweight’ rating and a $48 price target, noting that expectations for the business had become more reasonable and pointing to the addition of other growth drivers for FY26.

Investors Look Beyond Near-Term GLP-1 Pressure

Competition in the GLP-1 weight-loss space continues to broaden. Novo Nordisk and Eli Lilly dominate the market with Wegovy and Zepbound, respectively, and Lilly’s injectable Zepbound has been shown in a head-to-head study to deliver greater average weight loss than Wegovy. Novo has since launched the first FDA-approved oral GLP-1 for weight loss, while Lilly is advancing its own oral candidate, orforglipron, which is under regulatory review. Both companies have also cut cash-pay prices for lower doses as access expands beyond insurance-covered channels.

Beyond Novo and Lilly, other drugmakers are developing next-generation obesity treatments, including Lilly’s retatrutide and Novo’s CagriSema, while additional companies such as Pfizer and Structure Therapeutics are working on oral weight-loss drugs.

How Did Stocktwits Users React?

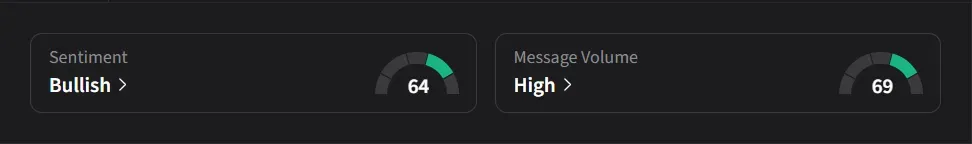

On Stocktwits, retail sentiment was ‘bullish’ amid ‘high’ message volume.

One user said, “Injections vs pills for weight loss will be a big deal. Who wouldnt rather take a pill. HIMS needs to get Novo deal or somehow get access to sell the pill, otherwise their weight loss related revenue will tank”

Another user said that with GLP-1 pills now available through large retailers such as Costco, the downside risks are already reflected in the stock price, and added that future catalysts could include share buybacks and increased trading activity.

Hims’ stock has risen 30% over the past 12 months.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2262983094_jpg_2896f12e4a.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_4530_jpeg_a09abb56e6.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2033244575_jpg_3f112039eb.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2256076198_jpg_06e5c2fdb6.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/IMG_9209_1_d9c1acde92.jpeg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_pharma_stock_jpg_490939e580.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_8805_JPG_6768aaedc3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_stablecoin_rep_jpg_5ec196dfc2.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2228901342_jpg_7365e02c40.webp)