Advertisement|Remove ads.

Viking Therapeutics Stock Suffers Worst Day In Over 4 Months As Top Execs Dump Shares — Novo’s $149 Wegovy Move Looms

- Regulatory filings showed share sales by Viking’s CEO, CFO and COO on Monday.

- Novo Nordisk announced oral Wegovy pricing starting at $149 a month in the U.S.

- Viking’s lead obesity drug VK2735 is still in Phase 3 clinical trials.

Shares of Viking Therapeutics Inc. fell sharply on Monday, logging their worst day in more than four months, after regulatory filings showed significant share sales by the company’s top executives.

The stock fell 9.3% to $32.14 in Monday’s regular session before paring some losses with a slight after-hours gain.

According to the company’s filings on Monday, Brian Lian, Viking’s president and chief executive officer, sold 233,409 shares, stock worth about $7.7 million. On the same day, Greg Zante, the company’s chief financial officer, sold 57,661 shares valued at roughly $1.9 million, while Marianna Mancini, Viking’s chief operating officer, sold 57,661 shares, also worth about $1.9 million.

Novo’s Wegovy Pricing Adds Competitive Pressure

The insider selling came as investors digested a major pricing move by Novo Nordisk, which announced that U.S. customers can obtain the oral version of Wegovy starting at $149 per month. Novo said the 1.5 mg and 4 mg doses would be available to self-paying customers at that price beginning Monday, although the cost of the 4 mg dose will rise to $199 per month from April 15. The company added that higher 9 mg and 25 mg doses are priced at $299 per month, with no promotional offers.

Novo also said customers with commercial insurance could pay as little as $25 per month for the oral pill. The announcement followed the FDA approval of oral Wegovy, making it the first oral GLP-1 drug approved for weight loss.

Viking’s Obesity Program

Viking's lead obesity candidate, VK2735, is a dual GLP-1/GIP receptor agonist being developed in both subcutaneous and oral formulations. In November, Viking said it finished enrolling patients ahead of schedule in its Phase 3 Vanquish-1 trial, which is testing a once-weekly injection of VK2735 over 78 weeks in about 4,650 adults who are obese or overweight and have at least one weight-related health condition.

The primary endpoint of the study is to measure the change in body weight relative to placebo, while also tracking the proportion of patients who achieve 5%, 10%, 15%, and 20% weight loss. Viking is also running a second Phase 3 trial, Vanquish-2, in overweight or obese patients with type 2 diabetes, with enrollment expected to finish in the first quarter of 2026. Earlier Phase 2 results showed patients lost up to 14.7% of their body weight in 13 weeks, which Viking said met its primary and secondary endpoints.

Wall Street Backs Viking

In October, Canaccord initiated coverage of Viking Therapeutics with a ‘Buy’ rating and a $106 price target, calling Viking “a leader in the obesity drug development space.” The firm expects readouts from Viking’s two Phase 3 trials in 2027 and mid-2028, respectively, and pointed to what he described as “strong” Phase 2 efficacy data from the oral version of VK2735 reported in August. He added that Canaccord believes VK2735 could differentiate on “multiple fronts.”

How Did Stocktwits Users React?

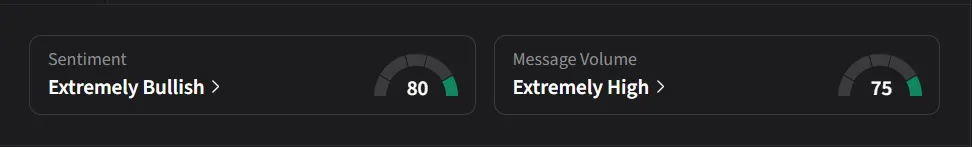

On Stocktwits, retail sentiment for Viking was ‘extremely bullish’ amid ‘extremely high’ message volume.

One user said they would be a “buyer if this comes down to the mid-20s. Already have a position but would love to add more at a discount.”

Another user pointed out that the insider selling “kills some buyout chances in near future.”

Viking’s stock has declined 25% over the past 12 months.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2222519332_jpg_15709268a8.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/IMG_9209_1_d9c1acde92.jpeg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Plug_Power_jpg_08143c7fa0.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_stablecoin_rep_jpg_5ec196dfc2.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_immunitybio_jpg_eb6402d336.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_8805_JPG_6768aaedc3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_pharma_stock_jpg_c9a7452f1f.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_agilent_jpg_3c602c748e.webp)