Advertisement|Remove ads.

Ford's $2.5B Tariff Shock, Pulled Guidance Doesn't Deter Retail Optimism

Shares of Ford Motor Co. (F) closed lower on Monday and slid further in after-hours trading, as a cautious outlook tied to U.S. tariff uncertainties overshadowed a quarterly earnings beat. Retail traders, however, appeared unfazed.

The Dearborn, Michigan-based legacy automaker posted adjusted earnings per share of $0.14, much better than an expected $0.02, while revenue of $40.66 billion also topped Wall Street's estimate of $35.79 billion.

“Ford Pro [the commercial vehicle business], our largest competitive advantage, is off to a strong start to the year, gaining market share in the most profitable U.S. and European customer segments,” said CEO Jim Farley in prepared remarks.

However, the company suspended its full-year 2025 guidance, citing “substantial industry risks” tied to President Donald Trump’s tariffs, potential supply chain disruptions, and policy uncertainty.

While Ford’s underlying business remains solid — with adjusted EBIT still tracking within its $7 billion–$8.5 billion guidance range, excluding new tariffs — the company now expects a $1.5 billion net hit to adjusted EBIT this year from tariff-related headwinds.

The gross impact could reach $2.5 billion, Ford added. Notably, that’s lower than General Motors’ estimated $5 billion hit, even after the recent removal of stacked tariffs on imports like steel and aluminum.

The automaker warned of rising industrywide prices due to tariffs and noted it has already halted vehicle exports to China.

Despite the macro challenges, Ford posted its best Q1 pickup truck sales in the U.S. in 20 years and said it remains on track to deliver $1 billion in net cost improvements.

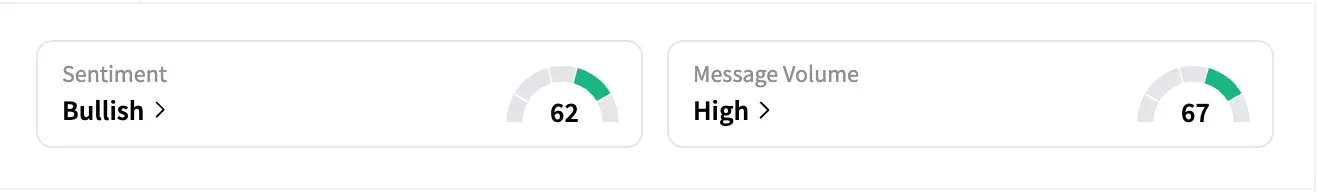

On Stocktwits, sentiment for Ford ended on a ‘bullish’ note on Monday, with 24-hour message volume soaring by over 1,000%.

Although several retail user posts indicated caution amid tariff uncertainties, many still pinned hopes on the stock as a safe dividend-paying play.

One watcher said, referring to the remainder of Trump's term, “We will get through” in just three-and-a-half years. They also urged investors to buy the dip “on all great American companies.”

“Always going to get a selling on the news dip,” said another. “I expect we'll be back above 10 tomorrow morning.”

Short interest on Ford’s stock has risen from 2.8% at the start of the year to 4.0% as of last week, according to Koyfin data.

“Last year, we assembled over 300,000 more vehicles in the U.S. than our closest competitor. That includes 100% of all our full-size trucks,” Farley said on the earnings call.

He added: “It's clear, however, that in this new environment, in which automakers with the largest U.S. footprint will have a big advantage. And boy, is that true for Ford. It puts us in pole position.”

Ford shares have gained over 2.6% as of the last close, faring much better than GM’s 14.8% slide and Jeep maker Stellantis’ 27% tumble.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_China_i_Phone_jpg_bcedab655a.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_American_Airlines_Getty_4d3d704837.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/vivekkrishnanphotography_58_jpg_0e45f66a62.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_sabre_resized_jpg_fa5aa35db6.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2049107660_jpg_906b4acd1f.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2203496924_jpg_18e024f0e6.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2195819624_jpg_841341254c.webp)