Advertisement|Remove ads.

Frontline Stock Rises On Upbeat Revenue As Investors Ignore Earnings Fall: CEO Acknowledges Soft Q4 But Retail Turns Bullish

Shares of oil tanker shipping company Frontline plc (FRO) rose nearly 1% in Friday’s pre-market session after its fourth-quarter revenue topped Wall Street expectations.

Frontline reported a 7% rise in revenue to $443.49 million compared to a Wall Street estimate of $273.16 million, according to Finchat data. Adjusted earnings per share (EPS) came in at $0.20, aligning with analyst estimates.

Net income decreased significantly to $66.73 million compared to $118.37 million in the same quarter a year ago.

CEO Lars H. Barstad acknowledged that the fourth quarter (Q4) came in unusually soft compared to previous years. Although global oil demand rose marginally toward the end of 2024, global seaborne exports slowed in the fourth quarter, he noted.

“During the quarter, we saw positive developments in the enforcement of sanctions against Iran and Russia in particular, but we could not escape the fact that these two countries represent a material part of the supply to Asia, at cost to demand for the vessels Frontline operates,” he said.

In February, Frontline entered into three senior secured credit facilities for up to $239 million to refinance three existing term loan facilities. The balloon payments of $142 million will mature in 2025. The company will have no debt maturities until the end of 2026.

Frontline also sold its oldest Suezmax tanker for a net sales price of $48.5 million. It delivered the vessel to its new owner in October 2024, generating net cash proceeds of $36.5 million after repaying existing debt and a gain of $17.9 million in the fourth quarter.

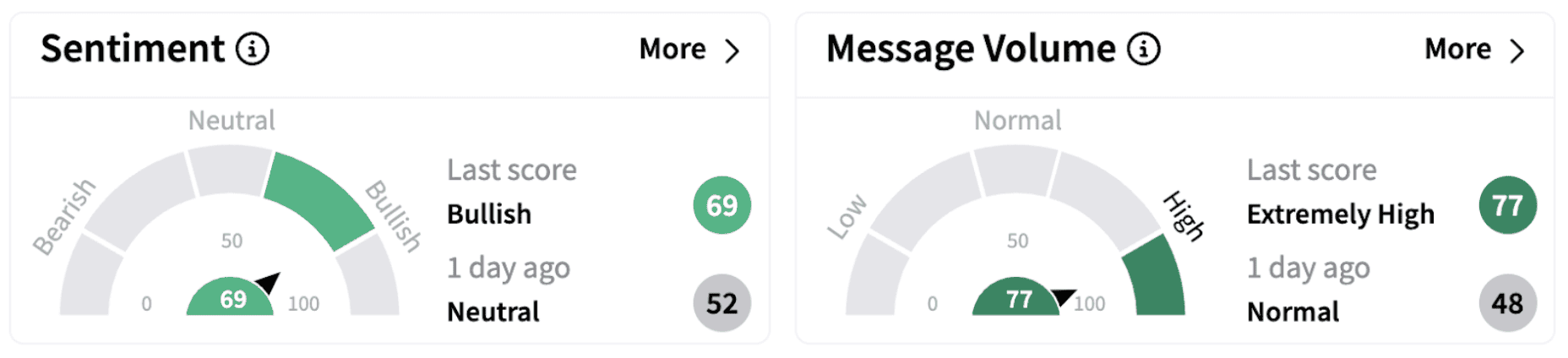

Following the announcement, retail sentiment on Stocktwits flipped into the ‘neutral’ territory (69/100) from ‘neutral’ a day ago. The move was accompanied by significant retail chatter.

FRO shares have gained over 4% in 2025 but are down over 32% over the past year.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_lucid_gravity_jpg_173d7fb4ec.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2250240969_jpg_dd9be8c5ea.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/shivani_photo_jpg_dd6e01afa4.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Trump_jpg_4a30f2c834.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Rounak_Author_Image_7607005b05.png)

/filters:format(webp)https://news.stocktwits-cdn.com/large_donald_trump_tariffs_chart_jpg_9309f5e523.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2242061511_jpg_742d610600.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/vivekkrishnanphotography_58_jpg_0e45f66a62.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2164981884_1_jpg_100f5d0da3.webp)