Advertisement|Remove ads.

FTAI Stock Hits Record High After Launching New Power Division For Data Centers

- The new platform will convert widely used CFM56 engines into 25-megawatt aeroderivative turbines.

- RBC Capital noted that the move into aeroderivative turbines could broaden demand for CFM56 engines beyond aviation.

- The company expects to produce more than 100 turbine units annually.

Shares of FTAI Aviation (FTAI) hit an all-time-high on Tuesday after the company launched a new energy division called FTAI Power, marking an extension of its aerospace engine expertise into the global power supply sector.

The initiative aims to repurpose CFM56 aircraft engines into aeroderivative gas turbines tailored to feed the growing electricity needs of data centers.

New Power Push

The new platform will convert widely used CFM56 engines into 25-megawatt aeroderivative turbines designed for flexible operation, with production slated to begin in 2026. FTAI stated that its extensive maintenance infrastructure and large engine fleet position it well to deliver reliable energy solutions as data center operators face delays in securing grid connections.

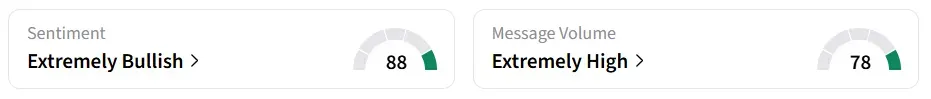

At the time of writing, FTAI stock pared some of the gains and traded over 13% higher. On Stocktwits, retail sentiment around the stock jumped to ‘extremely bullish’ from ‘neutral’ territory the previous day. Message volume shifted to ‘extremely high’ from ‘low’ levels in 24 hours.

“We believe FTAI Power will be a critical partner for the AI economy, which requires unparalleled amounts of electricity faster and in a more flexible format.”

- David Moreno, COO, FTAI

RBC Capital Backs The Move

RBC Capital maintained its optimistic view of the aerospace and energy hybrid strategy, noting that the move into aeroderivative turbines could broaden demand for CFM56 engines beyond aviation. The firm has an ‘outperform’ rating on the stock with a price target of $200.

FTAI already owns and services more than 1,000 CFM56 engines and maintains over one million square feet of facilities dedicated to engine maintenance, repair, and overhaul. By leveraging this existing expertise and supply chain, the company expects to produce more than 100 turbine units annually.

FTAI stock has gained 36% year-to-date.

Also See: SoftBank Reportedly Closes $40 Billion OpenAI Investment

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Getty_Images_2185805420_fotor_2025011795638_6fbb0bb63f.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_4530_jpeg_a09abb56e6.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_us_stocks_jpg_64b4ea4fc0.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_8805_JPG_6768aaedc3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2207049226_jpg_7f1e685123.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_us_stocks_war_jpg_f2a208ae56.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_M_and_A_deals_acquisitions_resized_jpg_a56d5b5e28.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_semtech_logo_resized_jpg_f9b0e1e71e.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)