Advertisement|Remove ads.

This Sports Streaming Stock Surged 18% Today: Find Out What’s Happening

FuboTV Inc. (FUBO) stock received a boost from Wedbush after the firm increased its price target on the stock to $6, up from the previous $5, and maintained its ‘Outperform’ rating.

The brokerage highlighted early second-quarter (Q2) numbers as promising, while noting the company’s outlook remained cautious, as per TheFly.

FuboTV stock traded over 19% higher on Wednesday afternoon.

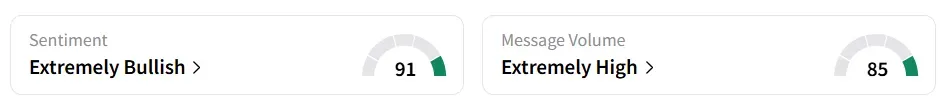

On Stocktwits, retail sentiment around the stock remained in ‘extremely bullish’ (91/100) territory amid ‘extremely high’ (85/100) message volume levels.

Both retail sentiment and message volume were at a six-month high. The stock saw a 295% surge in user message count in the last 24 hours.

A bullish Stocktwits user said they are going long on the stock.

Another user said the stock is still undervalued.

Despite a drop in subscribers compared to last year, Wedbush anticipates that FuboTV will return to user growth as it prepares to introduce slimmer, more affordable channel bundles in the coming months.

The management's efforts to streamline operations and control expenses seem to be working, with Wedbush noting that the company is on track to deliver positive EBITDA (Earnings Before Interest, Taxes, Depreciation, and Amortization) for the quarter.

Fubo indicated it expects to surpass prior guidance on both revenue and subscriber growth in North America and international markets.

In its core North American market, Fubo forecasts Q2 revenue above $365 million, ahead of its earlier estimate of $345 million.

Paid subscribers in the region are projected to top 1.35 million, beating the previous midpoint guidance of 1.24 million.

Internationally, Fubo expects Q2 revenue to exceed $8.5 million, surpassing the earlier forecast of $7 million.

Global subscriber numbers are expected to exceed 340,000, above the 330,000 previously projected.

FuboTV stock has gained over 234% in 2025 and over 190% in the last 12 months.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Data_center_jpg_5f0fa8e828.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_4530_jpeg_a09abb56e6.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_bitcoin_OG_oct23_jpg_588046d0a9.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_nio_battery_swap_jpg_de98f34bea.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_8805_JPG_6768aaedc3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_michael_saylor_strategy_2013_resized_jpg_e358c15fd4.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1760545615_jpg_9507fd561a.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/IMG_9209_1_d9c1acde92.jpeg)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_trader_stock_chart_resized_861d098b1f.jpg)