Advertisement|Remove ads.

GameSquare Ignites Retail Buzz With $250M Crypto Strategy And NFT Yields

GameSquare Holdings Inc. (GAME) ramped up its involvement in digital assets on Monday, announcing plans to expand its Ethereum (ETH)-focused treasury and introducing a new program designed to generate income through NFTs (non-fungible tokens).

The Texas-based company announced that its Board of Directors has approved an increase in crypto treasury management authorization from $100 million to $250 million.

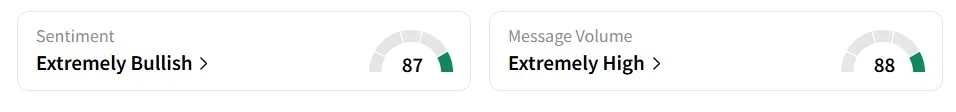

Despite the news, GameSquare stock traded over 8% lower on Monday afternoon. But on Stocktwits, retail sentiment toward the stock remained in ‘extremely bullish’ (87/100) territory amid ‘extremely high’ (88/100) message volume levels.

Retail message count around GameSquare surged by over 100% in the last 24 hours.

A user said this is a good opportunity, considering the recent crypto surge.

Another bullish user heaped praises on the stock.

As part of this new direction, the company has introduced a plan to deploy $10 million into Ethereum-native NFTs and yield-generating assets, aiming for annualized returns between 6% and 10%.

GameSquare has actively increased its Ethereum holdings, recently acquiring about 8,351 ETH for $30 million at an average price of $3,592 per token.

Altogether, the company has purchased roughly $35 million worth of ETH and now holds more than 10,170 ETH, with all purchases falling under the new $250 million authorization framework.

Diverging from traditional passive crypto investments, the company’s latest NFT initiative focuses on maximizing capital efficiency through stablecoin-generating protocols.

GameSquare plans to invest in Ethereum-native digital art and collectibles that align with its creative mission, while leveraging decentralized finance (DeFi) mechanisms to unlock steady yields and growth potential from its ETH-based holdings.

To ensure accountability, GameSquare has established a digital asset investment committee that reports directly to the Board, enforcing strict compliance, security, and valuation controls.

The company plans to reinvest the returns from this strategy into further Ethereum acquisitions or to support company expansion.

GameSquare stock has added 68% year-to-date and over 34% in the last 12 months.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2249860610_jpg_2888fdef75.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_4530_jpeg_a09abb56e6.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_novo_nordisk_ozempic_wegovy_jpg_786cdf3b34.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_8805_JPG_6768aaedc3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_brian_armstrong_coinbase_2_jpg_59a44ebea9.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2213364581_jpg_86d1ff954e.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_cathiewood_OG_jpg_a3c8fddb3f.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Micron_jpg_7058d4986a.webp)