Advertisement|Remove ads.

Retail Sees D-Wave Enjoying First-To-Market Advantage As Many Firms Eye Quantum Adoption Within 2 Years

D-Wave Quantum Inc. (QBTS) released a new study on Monday, showing that an increasing number of companies are beginning to explore quantum computing as a tool to enhance their ability to solve complex business problems.

The survey, which gathered insights from 400 decision-makers across North America, Europe, and the Asia-Pacific region, found that more than half plan to adopt quantum computing within two years.

Following the survey, D-Wave Quantum stock rose by over 3% on Monday afternoon.

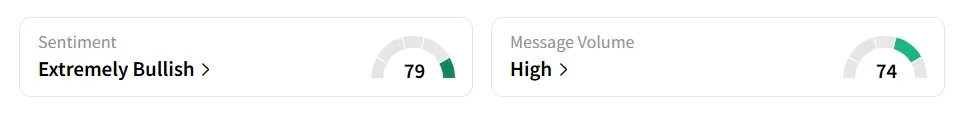

On Stocktwits, both retail sentiment and message volume levels around the stock hit a one-month high, remaining in ‘extremely bullish’ (80/100) territory with ‘high’ (74/100) message volume levels.

A user stated that the company has a first-to-market advantage in terms of optimization.

Another user said they will be adding to their position.

The study, conducted in partnership with Wakefield Research, revealed that a significant majority of global business leaders believe they’ve maxed out the performance limits of classical computing when it comes to optimization challenges.

As organizations seek to enhance efficiency and remain competitive, 53% of respondents confirmed plans to integrate quantum solutions into their workflows, while another 27% are exploring this idea.

A quarter of early adopters reported tangible improvements, while half anticipate that quantum tech will disrupt their industries soon.

Among those implementing or planning to implement these solutions, 46% expect a return on investment ranging between $1 million and $5 million, with 27% forecasting returns exceeding $5 million within the first year.

Quantum computing firms are gaining momentum as quantum systems show promise in tackling highly complex problems that traditional computers can't efficiently solve.

D-Wave Quantum stock has more than doubled year-to-date and has added over 1,800% in the last 12 months.

Also See: Verizon Lifts 2025 Cash Flow Forecast: Retail Says Stock Is ‘Recession-Proof’

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2195701587_jpg_dde6526b92.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/shivani_photo_jpg_dd6e01afa4.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_core_scientific_coreweave_OG_jpg_58f1ea2dbf.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2255969940_jpg_0903b745a1.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Rounak_Author_Image_7607005b05.png)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2218181288_jpg_d22b8a81ff.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/vivekkrishnanphotography_58_jpg_0e45f66a62.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_ryanair_michael_oleary_jpg_d2a378f59e.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_target_logo_resized_jpg_3025bd9bb0.webp)