Advertisement|Remove ads.

GameStop CEO Ryan Cohen Faces Lawsuit Over 2022 Bed Bath & Beyond Trades: Retail Stays Unfazed For Now

GameStop (GME) founder and CEO Ryan Cohen will reportedly face a lawsuit for his 2022 trades in shares of a company then known as Bed Bath & Beyond.

According to Reuters, a U.S. district judge has ordered the lawsuit to proceed.

In the lawsuit, the now-bankrupt Bed Bath said that Cohen and his RC Ventures bought and sold a more than 10% stake within six months, making them liable as insiders to repay "short-swing" profits or about $47.2 million.

Cohen said he was unaware that his ownership exceeded 10% when he invested in March 2022, attributing it to the company's discreet stock buybacks.

However, the judge reportedly pointed out that Bed Bath had publicly disclosed its repurchase plan, adding that it was hard to believe Cohen would make such a significant investment without examining investor filings.

According to the Reuters report, Cohen later exited his position in August 2022, reportedly earning around $60 million in profit.

Bed Bath filed for bankruptcy in April 2023. The e-commerce company Overstock.com later acquired its brand name and trademarks, which has since rebranded as Beyond (BYON).

The development comes weeks after Cohen-led GameStop approved a plan to buy Bitcoin as a treasury asset and raise $1.3 billion through convertible notes to fund that purchase.

Cohen is also a co-founder of online pet supplies retailer Chewy (CHWY), and according to Forbes, his net worth is estimated to be $4.3 billion.

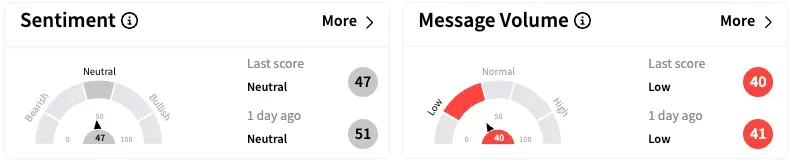

On Stocktwits, the retail sentiment was 'neutral', and message volume was 'low.'

Retail traders on Stocktwits, however, looked past the lawsuit news and posted about the strength in share trends, including a late rally in Monday's session.

Shares of GameStop are down 14.6% year to date.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_bitcoin_OG_oct23_jpg_588046d0a9.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_patrick_soon_shiong_jpg_5f4d6bc18d.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_8805_JPG_6768aaedc3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2246431195_jpg_539619e6b1.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/IMG_9209_1_d9c1acde92.jpeg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2262983094_jpg_2896f12e4a.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_4530_jpeg_a09abb56e6.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2033244575_jpg_3f112039eb.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2256076198_jpg_06e5c2fdb6.webp)