Advertisement|Remove ads.

Gary Black Expects Tesla Q3 Deliveries To Exceed Wall Street Estimates But Sees Full-Year Numbers Slip: Retail’s Divided On Stock Performance

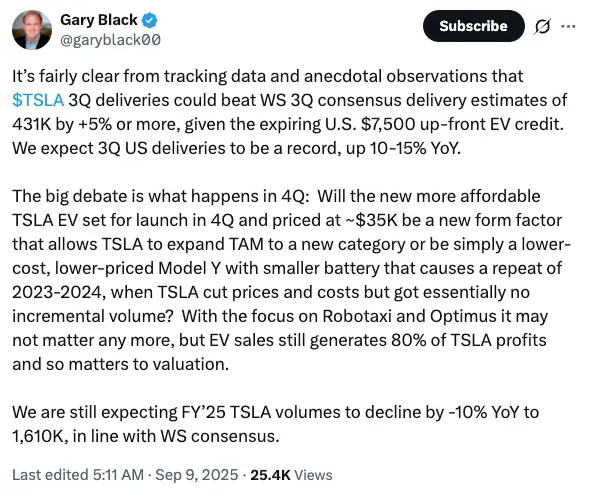

The Future Fund Managing Partner, Gary Black, on Tuesday said that he expects EV giant Tesla Inc’s (TSLA) third-quarter (Q3) deliveries to beat Wall Street estimates but sees annual deliveries decline by 10%.

The analyst said in a post on X that he now expects Tesla to report 5% more than the consensus delivery estimate of 431,000 vehicles, as the expiration of the federal tax credit on electric vehicle purchases draws close. In Q3 2024, Tesla reported 462,890 vehicle deliveries. “We expect 3Q US deliveries to be a record, up 10-15% YoY,” Black said.

Federal tax credit of $7,500 on new EV purchases, as well as the $4,000 credit on used EV purchases, are set to expire on September 30. The tax credit significantly reduces the starting price of EVs, and customers are rushing to make purchases to take advantage of the discount. Tesla, on its part, is currently urging customers to take delivery by September 30, while adding that it has limited inventory available.

On Stocktwits, retail sentiment around TSLA stock rose from ‘bearish’ to ‘neutral’ territory over the past 24 hours, while message volume stayed at ‘high’ levels. According to Stocktwits data, retail chatter around Tesla rose nearly 217% over the past 24 hours.

According to Black, the “big debate” will be what happens in the fourth quarter. According to the analyst, Tesla must not only launch a more affordable model to boost sales, but it must also have a different form factor and a starting price of $35,000 to expand its total addressable market.

A lower-cost, lower-price Model Y with a smaller battery will lead to no incremental volume, the analyst opined, referring to the 2023-2024 period when Tesla aggressively cut vehicle prices, which did not yield desired volumes.

While Tesla is currently attempting to shift its focus towards artificial intelligence and robotics with investments in self-driving taxis and humanoid robots, EVs still generate 80% of Tesla's profits, and this matters to valuation, Black said. Tesla reported a YoY decline in vehicle deliveries in both the first and second quarters of this year.

Black still expects Tesla’s full-year volumes to decline 10% year-over-year to 1.61 million, in line with the Wall Street consensus, down from the 1.77 million delivered in 2024. The Future Fund currently does not own Tesla shares after exiting its previous position. Black says the firm will reopen its position in Tesla stock only if the company’s share price falls to $240 or lower.

According to a Stocktwits user, TSLA stock is expected to reach $213 by the end of the year.

Another user, however, expects a rally to $450.

TSLA stock is down 14% this year but up approximately 60% over the past 12 months.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2260447662_jpg_cd246b74f6.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/IMG_9209_1_d9c1acde92.jpeg)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2254924116_jpg_d54ffea07e.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_US_stocks_3e2253bcca.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/Revised_Profile_JPG_0e0afdf5e2.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2228900989_jpg_e94daec744.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_4530_jpeg_a09abb56e6.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1445160636_jpg_9759816169.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_8805_JPG_6768aaedc3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Bitcoin_Red_OG_jpg_d64521f99a.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)