Advertisement|Remove ads.

GCPL Rallies: SEBI RA Eyes ₹1,365 Target Amid Q1 Momentum, Technical Breakout

Godrej Consumer Products (GCPL) shares rallied 6% on Monday, after the company shared a strong operational update for its first quarter (Q1 FY26).

Godrej Consumer anticipates its India operations will achieve high single-digit value growth this quarter, driven by mid-single-digit underlying volume growth (UVG).

SEBI-registered analyst Varunkumar Patel breaks down the rationale behind its upmove.

Standalone Strength: Patel noted that GCPL’s standalone business is set for high single-digit value growth, powered by mid-single-digit volume growth. If you exclude soaps from this, the company could see double-digit volume growth, with robust performance in its home care and personal care segments.

Consolidated Powerhouse: On a consolidated level, GCPL expects to see double-digit revenue growth, with India operations remaining solid, and Godrej Africa, USA, and the Middle East (GAUM) delivering double-digit value and volume growth for the second consecutive quarter.

Brokerages Bullish: Nomura maintained a ‘Buy’ rating with a target price of ₹1,485. HSBC has set a target of ₹1,420, cheering GCPL’s innovation and market share gains in home insecticides. They believe that, despite margin pressure in soaps, FY26 looks promising with mid-to-high single-digit volume growth and double-digit EBITDA growth.

On the technical charts, Patel highlighted that the stock is trading above its key moving averages: the 20-day Exponential Moving Average (EMA) at ₹1244.17, the 50-day EMA at ₹1230.80, and its 200-day EMA at ₹1180.65. Its Relative Strength Index (RSI) stands at 60 and Moving Average Convergence Divergence(MACD) is positive.

Patel suggested a short-term target of ₹1,300-₹1,365, with a stop-loss of ₹1,160 and a holding period of one month.

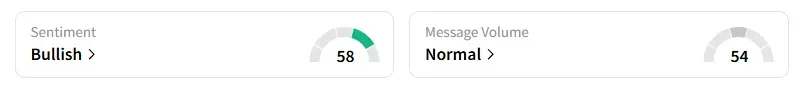

Data on Stocktwits shows that retail sentiment is ‘bullish’ on this counter.

GCPL shares have gained 17% year-to-date (YTD).

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_WU_Western_Union_dc673aaa7c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_Stock_market_Image_public_domain_declining_wc_96197f57d2.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/vivekkrishnanphotography_58_jpg_0e45f66a62.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2149589805_jpg_ceec7778b8.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Oil_drill_06147e8349.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Coinbase_c429427aa1.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Ford_jpg_186fb0eaa9.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)