Advertisement|Remove ads.

GE Aerospace Stock Rises After Company Unveils $1B Investment Plan For US Factories, Supply Chain: Retail Stays Bullish

Shares of GE Aerospace (GE) rose over 2% on Wednesday after the company said it plans to invest nearly $1 billion in its U.S. factories and supply chain to strengthen manufacturing and increase the use of innovative new parts and materials needed for the future of flight.

Of this, $500 million will be used to expand capacity to strengthen quality and delivery at several key sites, especially those that support the production and assembly of the narrow-body CFM LEAP engine. These engines are made by CFM International, a 50-50 joint company between GE Aerospace and Safran Aircraft Engines.

The company indicated it has earmarked investments of $113 million in Greater Cincinnati, $70 million in Michigan, $16 million in Durham, North Carolina, $5 million in Indiana, and $13 million in West Jefferson, North Carolina.

Moreover, a $200 million investment will go toward military engine production, with the company investing in sites including Lynn, Massachusetts, and Madisonville, Kentucky.

GE Aerospace will invest over $100 million in scaling the production of innovative parts made from new materials and advanced manufacturing processes that provide engines with more range, power, and efficiency.

Over $100 million would also be dedicated to the company’s external supplier base, providing investments to ensure suppliers use the newest tools to produce parts, further reducing defects and supply chain constraints.

CEO H. Lawrence Culp, Jr. said investing in manufacturing and innovation is more critical than ever for the future of the firm’s industry and the communities where it operates.

GE Aerospace said the new investment is nearly double last year’s commitment. The firm will hire around 5,000 U.S. workers this year, including manufacturing and engineering roles.

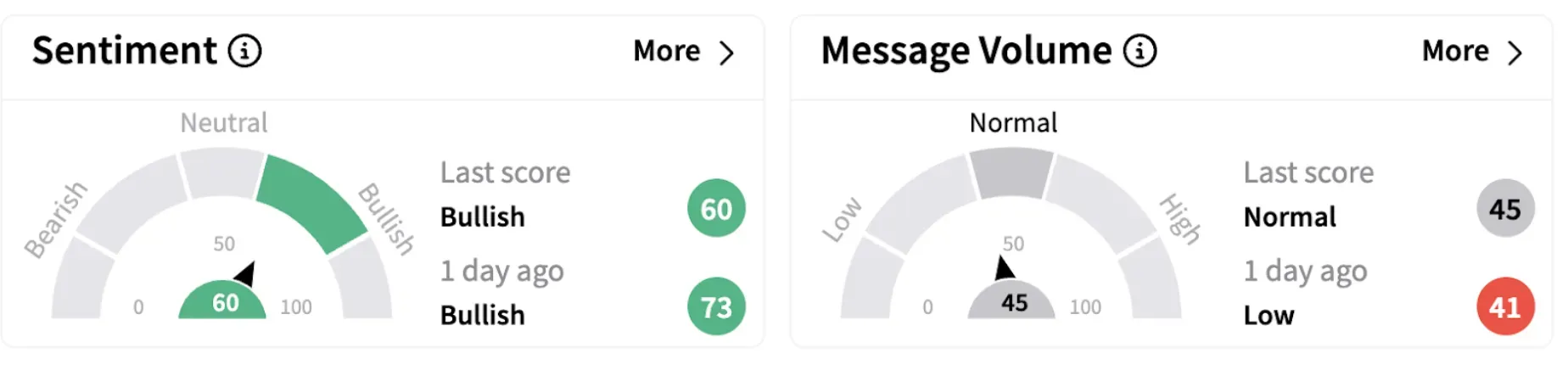

On Stocktwits, retail sentiment continued to trend in the ‘bullish’ territory (60/100), albeit with a lower score.

GE Aerospace started trading as an independent public company in April 2024 following the completion of the GE Vernova spin-off.

The stock gained over 16% in 2025.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2250929484_jpg_8206df84ab.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Rounak_Author_Image_7607005b05.png)

/filters:format(webp)https://news.stocktwits-cdn.com/large_dominos_resized_jpg_f70082df7e.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1198350622_jpg_c4fc77e19d.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/shivani_photo_jpg_dd6e01afa4.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_merck_logo_resized_05f46cfc54.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Trending_stock_resized_may_jpg_bc23339ae7.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/vivekkrishnanphotography_58_jpg_0e45f66a62.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_arthur_hayes_OG_jpg_734ff95af6.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)