Advertisement|Remove ads.

We Asked Retail If The US Is Headed Toward A Recession — A Narrow Majority Thinks The Fears Are Overblown

Recession fears took center stage this week, and markets witnessed a sell-off after President Donald Trump did not rule out a slowdown amidst the ongoing tariff wars, saying there is a period of transition.

"I hate to predict things like that," he said, talking about the recession. "There is a period of transition because what we're doing is very big. We're bringing wealth back to America. That's a big thing… It takes a little time, but I think it should be great for us.”

According to a CNBC report, Alec Kersman, managing director and head of Asia-Pacific at investment management firm PIMCO, said that the probability of a U.S. recession in 2025 has increased to 35% from the 15% estimated in December 2024.

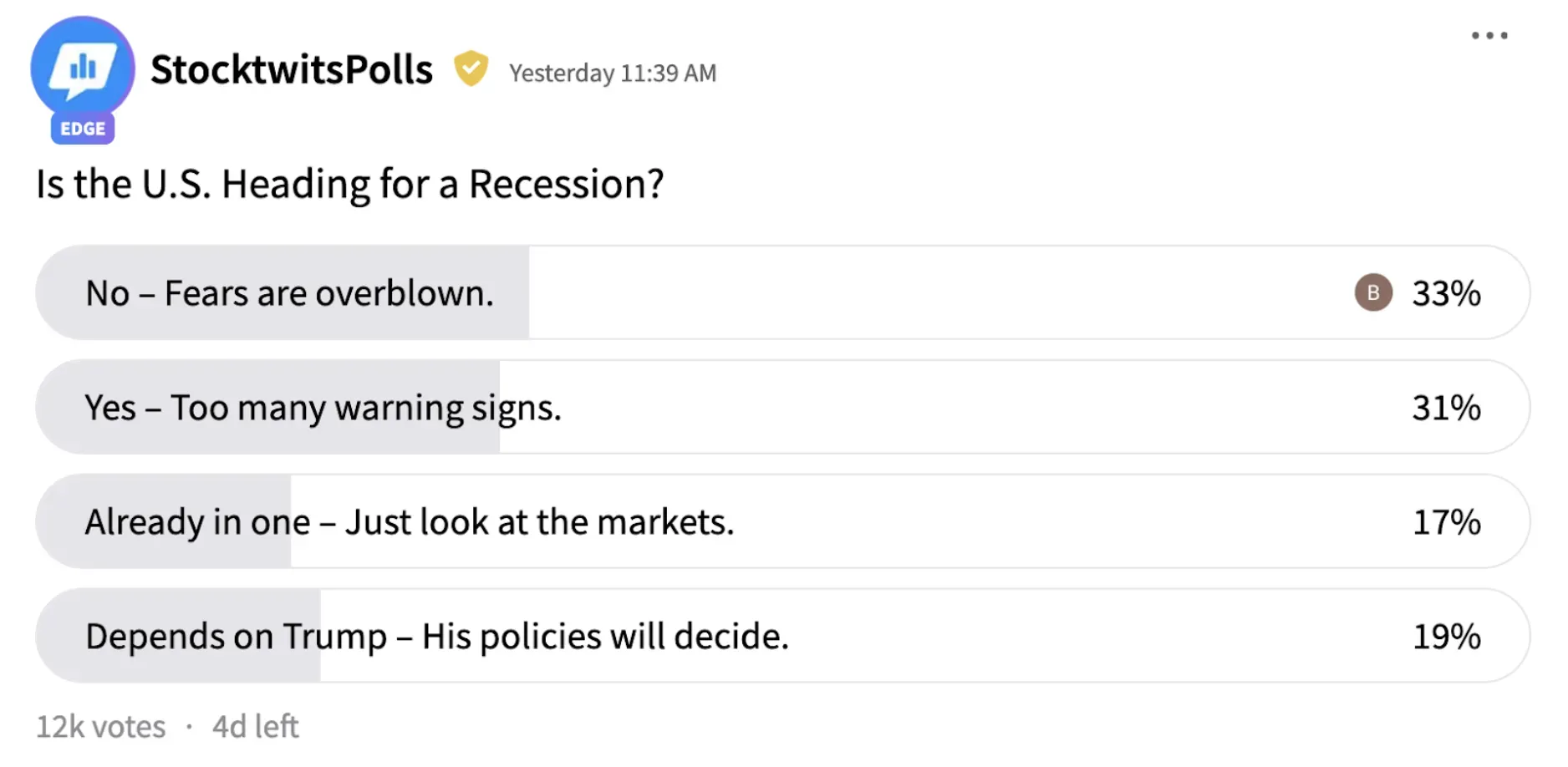

However, Stocktwits users have a different take. According to an ongoing poll on the platform that has garnered 12,000 votes, the majority of the respondents believe recession fears might be exaggerated.

Thirty-three percent of the respondents believe the fears are overblown, while 31% held a contrasting view that there are too many warning signs and that the U.S. is heading for a recession.

Nineteen percent of the respondents believe it all depends on Trump and his policies, while 17% believe the country is already in the grips of a recession.

One Stocktwits user criticized Trump for the slowdown.

Another defended the U.S. President, shifting the blame onto the previous administration.

Notably, U.S. Consumer prices rose less than expected in February, with the consumer price index (CPI) rising 0.2% month-on-month and 2.8% annually.

Core inflation, which excludes food and energy prices, rose 0.2% in February and increased 3.1% over the last 12 months.

Traders expect the Federal Reserve to maintain its status quo policy in March. A 25-basis-point rate cut has been factored in for June 2025.

Following the release of the inflation data, the markets initially cheered the figures but soon pared most of the gains.

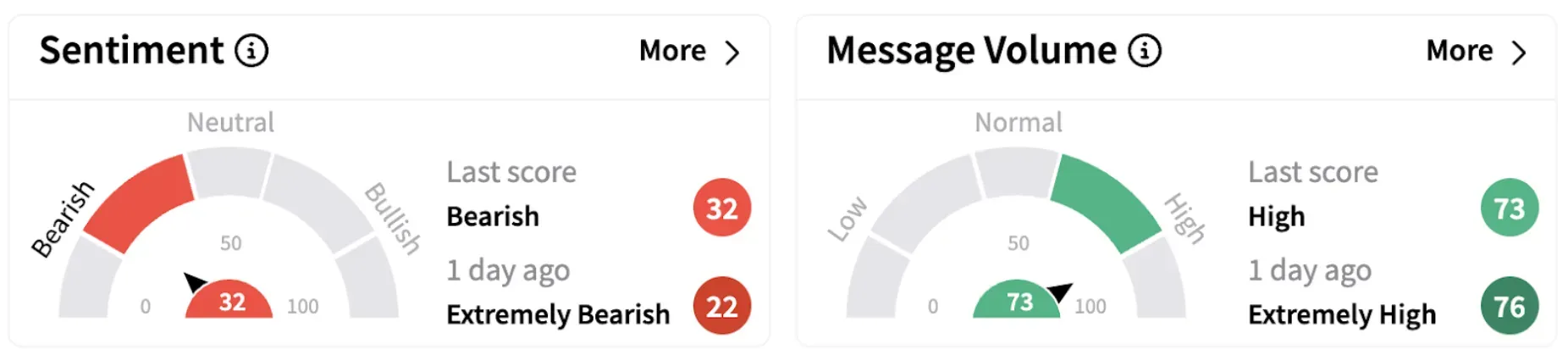

On Stocktwits, retail sentiment for the SPDR S&P 500 ETF Trust (SPY) and the Invesco QQQ Trust, Series 1 (QQQ) continued to trend in the ‘bearish’ territory on Wednesday morning.

Going forward, all eyes will be on the Fed’s policy decision, which will be crucial in determining the economy’s health.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2242061511_jpg_742d610600.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/vivekkrishnanphotography_58_jpg_0e45f66a62.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_eli_lilly_hq_resized_af4cc05fd5.jpg)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Rounak_Author_Image_7607005b05.png)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2204154647_jpg_b295df5f6b.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/shivani_photo_jpg_dd6e01afa4.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_MSTR_caaa0be909.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_atomera_logo_resized_97a56614c5.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2250240969_jpg_dd9be8c5ea.webp)