Advertisement|Remove ads.

GE Vernova Expands Collaboration With Amazon Web Services To Address Accelerating Energy Demand: Retail Stays Bullish

GE Vernova Inc. (GEV) announced on Tuesday that it has signed a strategic framework agreement (SFA) with Amazon Inc.’s (AMZN) Amazon Web Services, Inc. (AWS) to address the accelerating global energy demand.

Under the terms, GE Vernova will provide AWS with new offerings to electrify and decarbonize data centers across North America, Europe, and Asia.

This includes turnkey substation solutions to enable connectivity of AWS data centers to the grid, including the expansion of major electrical equipment, project management, and construction support across multiple sites globally. The engineering teams of both companies will continue to work together to optimize data center substation design and delivery.

The companies will also collaborate to enhance the path for commercializing onshore wind development projects.

At the same time, they will also explore additional opportunities for GE Vernova to provide power generation equipment and services to AWS as well as work with GE Vernova’s accelerator businesses to advance energy transition innovation, research, project development, and financing.

Meanwhile, AWS will provide GE Vernova cloud services solutions to advance its cloud migration and digital innovation efforts, including through generative AI.

Howard Gefen, general manager of energy and utilities at AWS, said this expanded collaboration will allow the company to accelerate data and energy efficiencies, driving reliable and more sustainable operations.

GE Vernova recently acquired Woodward, Inc.’s heavy-duty gas turbine combustion parts business based in Greenville, S.C. The acquisition supported the company’s strategy to invest in U.S. manufacturing and employment while also strengthening its domestic supply chain.

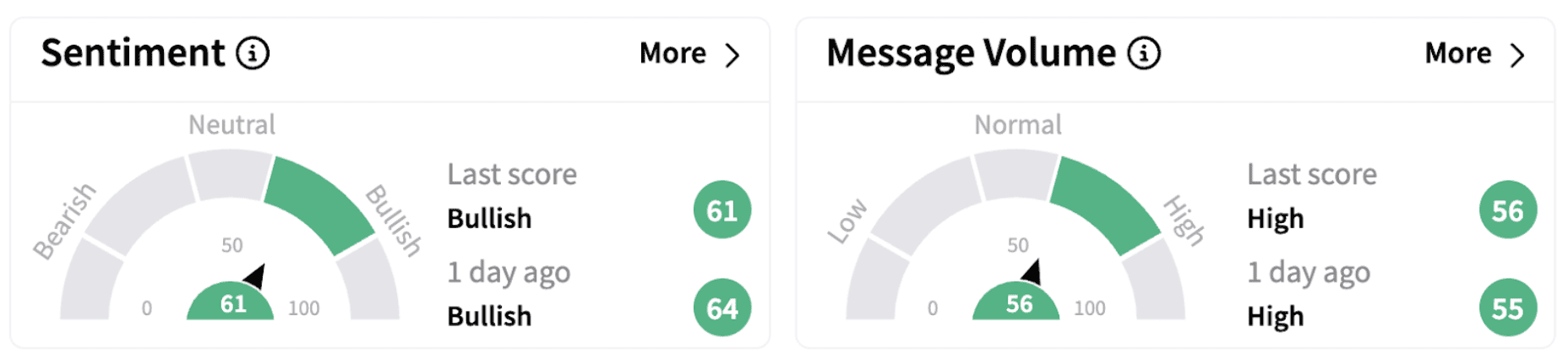

On Stocktwits, retail sentiment continued to trend in the ‘bullish’ territory (61/100), accompanied by ‘high’ message volume.

One Stocktwits user expects the shares to hit the $400 mark. However, broader market weakness driven by the tariff wars was reflected in the stock price, which was down over 4% on Tuesday.

GEV shares have lost over 10% this year but have gained over 130% over the past year.

Also See: CME Stock Draws Retail Cheer On Record Monthly Average Daily Volume In February

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_kevin_warsh_jpg_0c2cd19926.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_1959831267_jpg_c83b1e0d88.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/moderna_hq_resized_jpg_97563ed423.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2194622714_jpg_c18475d557.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_WU_Western_Union_dc673aaa7c.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_Stock_market_Image_public_domain_declining_wc_96197f57d2.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/vivekkrishnanphotography_58_jpg_0e45f66a62.webp)