Advertisement|Remove ads.

CME Stock Draws Retail Cheer On Record Monthly Average Daily Volume In February

CME Group Inc (CME) shares were in the limelight on Tuesday after the company registered a new monthly average daily volume (ADV) record of 33.1 million contracts, marking an increase of 12% year-over-year.

The highlight was the 234% surge in cryptocurrency ADV. CME reported a record monthly Ether futures ADV of 15,000 contracts. Micro Ether futures ADV jumped 374% to 94,000 contracts, while Micro Bitcoin futures ADV rose 209% to 76,000 contracts.

Last month, CME said it would introduce Solana futures on March 17, pending regulatory approval.

CME also said its deeply liquid interest rate complex reached a monthly ADV record of 19.2 million contracts. This was driven by record monthly U.S. Treasury futures and options ADV of 13 million contracts and a 15% increase in SOFR futures volume.

The company saw its Energy ADV rise by 11%. This included record February Energy options ADV of 552,000 contracts while its Henry Hub Natural Gas futures ADV rose 16% to 676,000 contracts.

CME also reported a 15% rise in its Agricultural ADV. The company said that corn futures ADV jumped 28% to 586,000 contracts, while Soybean futures ADV rose 9% to 318,000 contracts.

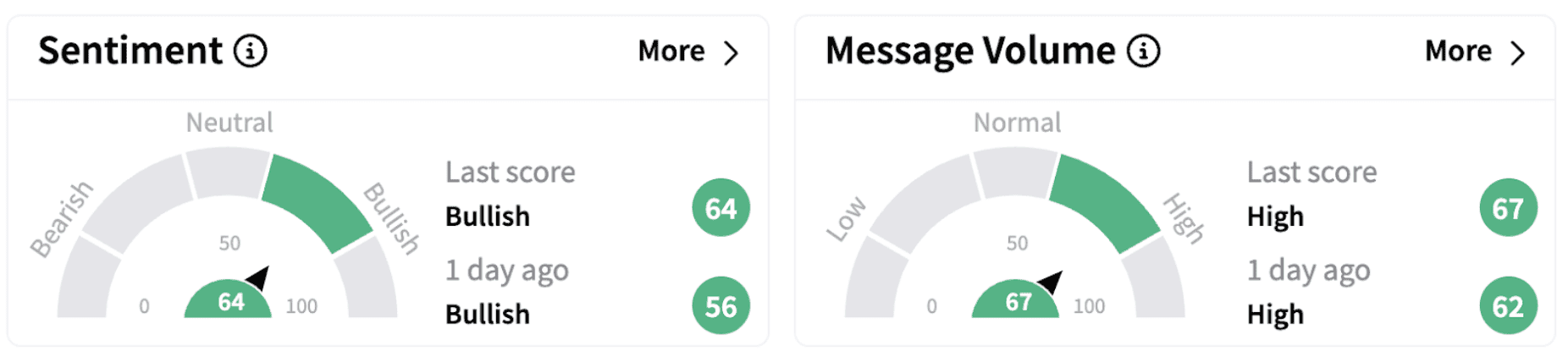

Following the February statistics disclosure, retail sentiment on Stocktwits climbed further into the ‘bullish’ territory (64/100), accompanied by ‘high’ message volume.

Last month, the company reported better-than-expected fourth-quarter earnings.

Revenue rose 6% year-over-year (YoY) to $1.53 billion compared to an analyst estimate of $1.51 billion. The company reported adjusted earnings per share (EPS) of $2.4 versus an estimated $2.45.

Net Income attributable to common shareholders of CME Group rose 7% YoY to $863.7 million.

CEO Terry Duffy highlighted that CME Group had its best year in 2024, generating record annual average daily volume, revenue, adjusted operating income, adjusted net income, and adjusted earnings per share.

CME shares have gained over 10% in 2025 and 16% over the past year.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_sealsq_stock_market_representative_resized_b05435011f.jpg)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2229918735_jpg_e905cbd5e3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1445160636_jpg_9759816169.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2250240977_jpg_5b777d96ef.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2206295220_jpg_1057588802.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Rounak_Author_Image_7607005b05.png)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Trending_stock_resized_may_jpg_bc23339ae7.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/vivekkrishnanphotography_58_jpg_0e45f66a62.webp)