Advertisement|Remove ads.

GE Vernova Stock Logs Weekly Decline After Wolfe Downgrade, Retail Leans Bearish

GE Vernova (GEV) stock posted a weekly decline after Wolfe Research downgraded the stock to ‘Peer Perform’ from ‘Outperform’, according to TheFly.

The brokerage reportedly did not add any price targets. According to FinChat data, the stock has a consensus price target of $443.38, implying a 7% downside compared to its previous close.

The Wolfe analyst noted on Friday that the downgrade "is all about valuation" following the stock's nearly 50% gain this year.

GE Vernova's path to achieve earnings before interest, taxes, depreciation, and amortization (EBITDA) between $12 billion and $15 billion by the end of the decade is now priced into the shares, the brokerage said.

The company has benefited from the soaring demand for power driven by the growth of artificial intelligence data centers. GE Vernova executives have noted that the growth in electricity demand is comparable to the boom that followed the Second World War.

Wolfe reportedly stated that many of the stock's positives are now adequately discounted, resulting in a more balanced relationship between risk and reward.

Earlier last week, BofA raised the stock’s price target to $550, after raising estimates for the earnings from its power segment.

According to The Fly, the brokerage expects 1,000 gigawatts of gross power generation capacity additions from now until 2035, with roughly one-third of these to be natural gas turbines, benefiting GE Vernova.

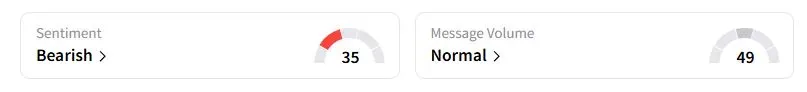

Retail sentiment on Stocktwits was ‘bearish’ (35/100) territory, while retail chatter was ‘normal.’

GE Vernova stock has gained 44% year to date and more than doubled over the past 12 months.

Also See: Oil Climbs As Israel-Iran Tensions Mount — Goldman Sachs Warns Of $100 Per Barrel Risk

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2187726936_jpg_ca6aee809e.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/vivekkrishnanphotography_58_jpg_0e45f66a62.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_us_capitol_building_OG_jpg_388637a98c.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2250929484_jpg_8206df84ab.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/IMG_9209_1_d9c1acde92.jpeg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1163170868_jpg_3975bd8be2.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2247687123_1_jpg_5a8fc404b7.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_4530_jpeg_a09abb56e6.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_coinbase_new_jul_2eaf8eb2ac.webp)