Advertisement|Remove ads.

Gensol Engineering Stock Plunges To Lower Circuit After SEBI Bars Promoters Over Alleged Fund Diversion: Retail Confidence Tanks

Gensol Engineering shares hit their lower circuit on Wednesday morning after tumbling 5%, a day after the Securities and Exchange Board of India (SEBI) issued interim orders against the company and its promoters for alleged fund diversion and falsification of records.

The order restrains Anmol Singh Jaggi and Punit Singh Jaggi from holding directorial positions and bars them from buying, selling, or dealing in securities until further notice.

The market regulator found fake documents, fund misuse, and fraudulent disclosures.

This order follows a probe after SEBI received complaints in June 2024 regarding share price manipulations and loan repayment delays.

The investigation revealed that the promoters misused company funds raised for buying electric vehicles under their ride-hailing business BluSmart to purchase a luxury flat in Delhi, among other discrepancies.

Gensol has put its proposed 1:10 stock split on hold. SEBI has appointed a forensic auditor to examine the company's books, with a report expected within six months.

From its record high of ₹1,147, Gensol Engineering's stock has already declined sharply to ₹122 as investor confidence takes a severe hit.

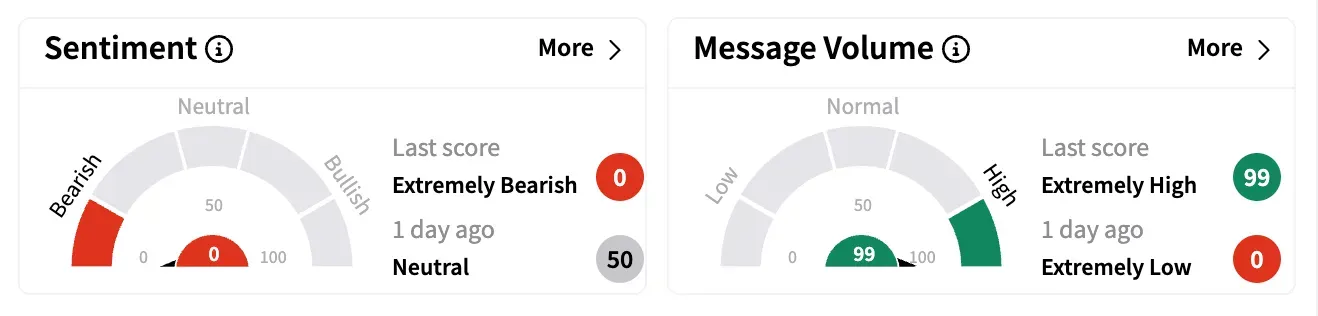

Data from Stocktwits indicates retail sentiment flipped to 'extremely bearish' levels on Wednesday, hitting its lowest level ever, with growing concerns around governance and transparency.

One user wondered if the worst was yet to come.

"This was fraud - wrapped in ESG, hyped by PR, and funded by silence," said another watcher.

Gensol Engineering is down 84% year-to-date (YTD).

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_jeff_merkley_jpg_aca807f10f.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Rounak_Author_Image_7607005b05.png)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_stock_rising_resized_f17852d7aa.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/shivani_photo_jpg_dd6e01afa4.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2230437216_jpg_6078a75ee4.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/vivekkrishnanphotography_58_jpg_0e45f66a62.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2149037439_jpg_ab9f73d5f7.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2205870374_jpg_15fedc8d2f.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_berkshire_hathaway_jpg_86250c27d6.webp)