Advertisement|Remove ads.

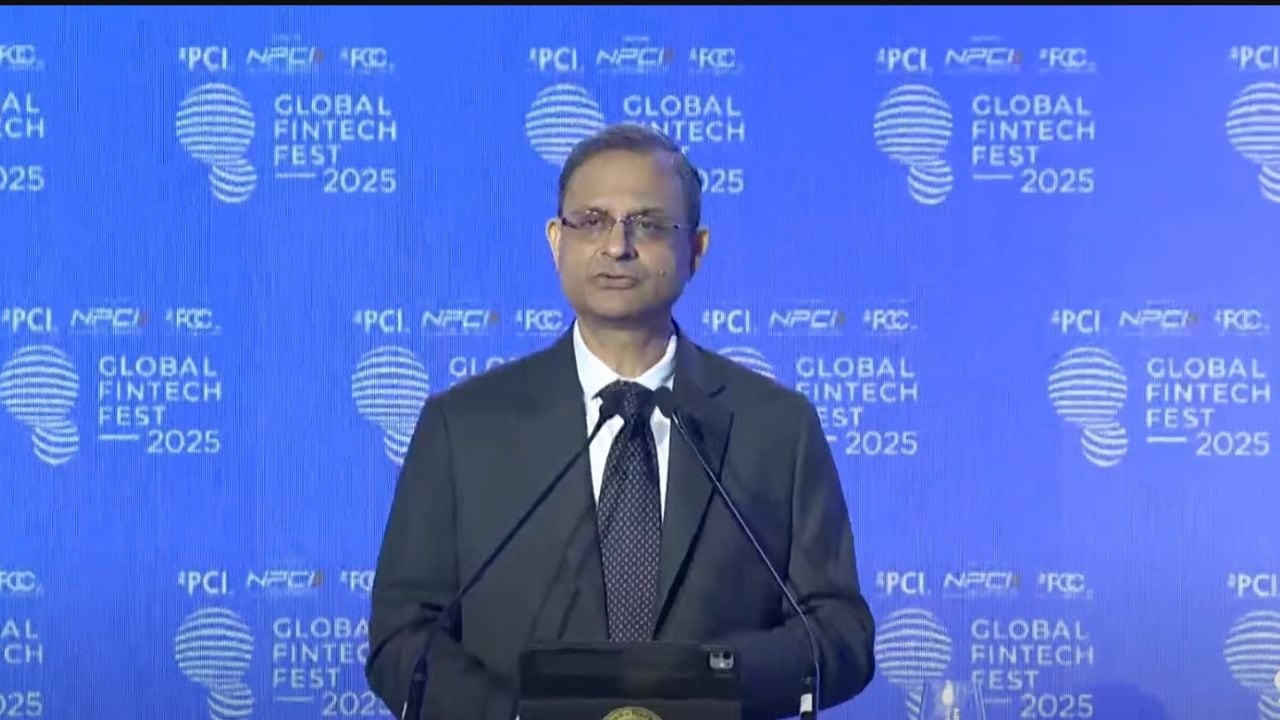

GFF 2025: RBI Governor Sanjay Malhotra shares five key thoughts for fintech industry

RBI Governor Sanjay Malhotra outlines five key principles for fintechs at Global Fintech Fest 2025, emphasising inclusion, innovation, trust, customer focus, and global-local strategy.

At the Global Fintech Fest (GFF) 2025, Reserve Bank of India (RBI) Governor Sanjay Malhotra outlined five guiding principles for fintech companies, aimed at accelerating financial inclusion and innovation in India’s digital economy.

RBI’s Governor's five key thoughts for fintechs

Build for inclusion – Malhotra urged fintechs to improve access for less-developed regions of India, designing products that are intuitive and easy to use for populations with lower digital literacy.

Adopt a customer-first approach – He encouraged companies to create frictionless experiences so that customers rarely need to rely on support, reducing pain points and improving engagement.

Innovate – Fintechs should extend the success of digital payments to small businesses and other underserved segments, exploring new products and services that enhance financial accessibility.

Prioritise trust – Compliance, data protection, transparency, and robust safeguards should be at the core of product design to foster confidence among users.

Think global, anchored local – Malhotra highlighted the importance of exchanging knowledge with international partners while strengthening India’s role in the global digital finance landscape.

During the event, Malhotra emphasised that India’s digital payments ecosystem has matured rapidly, with daily UPI transactions now accounting for half of global real-time payments. “Now it takes a few minutes to do something which used to take months, like filing returns, thanks to the availability of data,” he said.

The RBI Chief also highlighted technology initiatives such as DigiLocker and the IT backbone that enabled GST implementation.

Supporting innovation through RBI initiatives

Malhotra noted that RBI continues to support fintech growth via programs like exclusive internet domains, the Mule Hunter initiative, and a fintech repository that allows startups to operate largely outside regulatory constraints.

Work is also underway on a digital payments intelligence platform, while initiatives such as the Unified Market Interface (ULI) are landmark steps in data aggregation, enabling companies to leverage government datasets for smarter solutions.

Also Read:Developed nation status, $30-35 trillion economy by 2047 well within reach: Piyush Goyal

RBI’s Governor's five key thoughts for fintechs

Build for inclusion – Malhotra urged fintechs to improve access for less-developed regions of India, designing products that are intuitive and easy to use for populations with lower digital literacy.

Adopt a customer-first approach – He encouraged companies to create frictionless experiences so that customers rarely need to rely on support, reducing pain points and improving engagement.

Innovate – Fintechs should extend the success of digital payments to small businesses and other underserved segments, exploring new products and services that enhance financial accessibility.

Prioritise trust – Compliance, data protection, transparency, and robust safeguards should be at the core of product design to foster confidence among users.

Think global, anchored local – Malhotra highlighted the importance of exchanging knowledge with international partners while strengthening India’s role in the global digital finance landscape.

During the event, Malhotra emphasised that India’s digital payments ecosystem has matured rapidly, with daily UPI transactions now accounting for half of global real-time payments. “Now it takes a few minutes to do something which used to take months, like filing returns, thanks to the availability of data,” he said.

The RBI Chief also highlighted technology initiatives such as DigiLocker and the IT backbone that enabled GST implementation.

Supporting innovation through RBI initiatives

Malhotra noted that RBI continues to support fintech growth via programs like exclusive internet domains, the Mule Hunter initiative, and a fintech repository that allows startups to operate largely outside regulatory constraints.

Work is also underway on a digital payments intelligence platform, while initiatives such as the Unified Market Interface (ULI) are landmark steps in data aggregation, enabling companies to leverage government datasets for smarter solutions.

Also Read:Developed nation status, $30-35 trillion economy by 2047 well within reach: Piyush Goyal

Read about our editorial guidelines and ethics policy

/filters:format(webp)https://news.stocktwits-cdn.com/large_ford_ev_jpg_0edcd01202.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_best_buy_resized_jpg_b0e183ee15.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_4530_jpeg_a09abb56e6.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_fed_seal_original_jpg_4de793e501.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Rounak_Author_Image_7607005b05.png)

/filters:format(webp)https://images.cnbctv18.com/uploads/2022/12/Razorpay.jpg)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/cnbctv18logo.png)

/filters:format(webp)https://news.stocktwits-cdn.com/large_tom_lee_fundstrat_bmnr_OG_jpg_94a105e116.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_A_modern_Verizon_retail_store_in_Burlington_Vermont_1_534b6f1fee.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/shivani_photo_jpg_dd6e01afa4.webp)