Advertisement|Remove ads.

Bullish Breakout: Glenmark Pharma Surges On AbbVie Deal, SEBI RA Sees Long-Term Gains

Glenmark Pharmaceuticals shares surged 15% on Friday, hitting a fresh 52-week high after the company signed an exclusive licensing deal with AbbVie for its cancer drug.

Glenmark’s subsidiary, Ichnos Glenmark Innovation (IGI), entered into an agreement with AbbVie for ISB 2001, an antibody currently in Phase 1B trials for multiple myeloma. This deal includes an upfront payment of $700 million and up to $1.23 billion in milestone payments, along with royalties on net sales, subject to regulatory clearances.

Under the terms of the agreement, Glenmark retains commercialization rights for India and emerging markets, while AbbVie will receive exclusive rights to develop, manufacture, and commercialize the drug across North America, Europe, Japan, and Greater China.

SEBI-registered analyst Akhilesh Jat noted that this strategic partnership validates Glenmark’s R&D capabilities and also unlocks global revenue potential through milestone and royalty payments. The stock reaction reflected this optimism around future earnings and long-term growth, he added.

On technical charts, the stock remains in a bullish trajectory. As long as Glenmark sustains above key support levels of ₹1,800 and ₹1,600, the upward momentum is expected to continue. Jat also observed that a firm hold above these levels suggested a base for further gains in the near term.

In other news developments, the company recently launched Tevimbra, a lung cancer treatment, in India after regulatory approval. The stock has surged over 30% in the last one month.

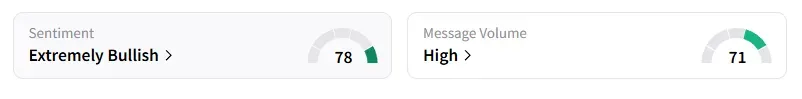

Data on Stocktwits shows retail sentiment rose to ‘extremely bullish’ amid ‘high’ message volumes.

Glenmark Pharma shares have risen 35% year-to-date (YTD).

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_adam_smigielski_K5m_Pt_O_Nmp_HM_unsplash_f365ee93f4.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_trump_jpg_fc59d30bbe.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1190665957_jpg_92088206ed.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2235337192_jpg_56c00409cf.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_marvell_logo_OG_jpg_dfc748dd9b.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2232147590_jpg_a31aecbfad.webp)