Advertisement|Remove ads.

GM's $6B Buyback Plan, Dividend Hike Ignite Retail Buzz With 400% Surge In Message Volume On Stocktwits

General Motors shares surged 3.75% on Wednesday, marking their best single-day gain in over a month, and extended gains after-hours as the automaker unveiled a significant share buyback plan and a 25% dividend increase.

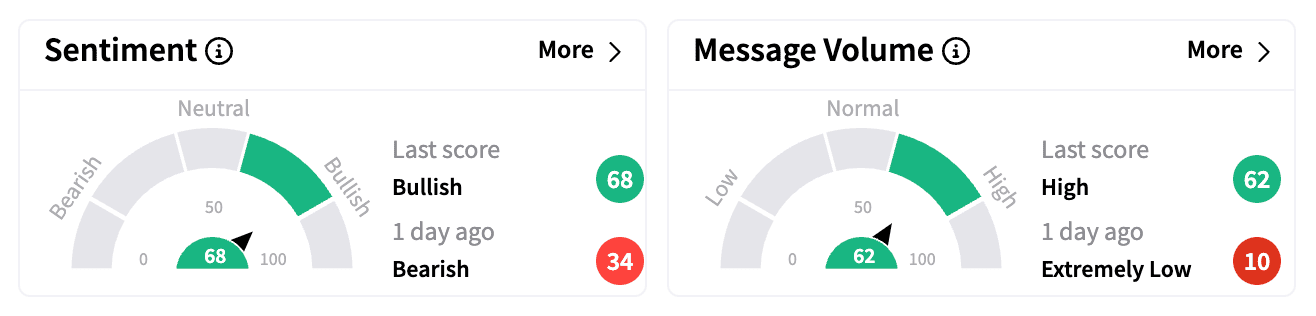

Retail investors jumped into the discussion, sending message volume on Stocktwits soaring 400% as sentiment flipped to 'bullish' levels.

GM's board approved a $0.03 hike in its quarterly dividend to $0.15 per share, starting with its next planned payout in April 2025.

The company also announced a $6 billion repurchase authorization, with an initial $2 billion buyback through an accelerated share repurchase program.

"We are growing our business thanks to our broad, deep, and compelling portfolio of ICE vehicles and EVs," said CEO Mary Barra. "At the same time, we are investing our capital in a disciplined and consistent way to continue generating strong margins and cash flows."

The automaker reaffirmed its 2025 capital spending guidance of $10 billion to $11 billion, including investments in battery cell manufacturing joint ventures.

Research and product development spending is expected to exceed $8 billion.

On Stocktwits, one user expected more upside from the news, saying if Tesla had announced a similar buyback, it would have added "like $500 billion to its market cap."

Others pointed to bullish technical patterns, with one predicting that GM's stock would touch $60 on the back of a possible "golden cross."

TradingView charts showed GM's 50-day moving average had already crossed its 100-day MA two weeks ago and was nearing a crossover with its 200-day MA.

Despite Wednesday’s jump, GM stock remains down over 9% this year, weighed down by concerns over potential U.S. tariffs on Canada and Mexico — key supply chain hubs for legacy automakers.

President Donald Trump reaffirmed Monday that sweeping tariffs on imports from both countries "will go forward" once the current delay expires next week.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_bitcoin_2026_4_jpg_bb96bc484b.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2249860610_jpg_2888fdef75.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_4530_jpeg_a09abb56e6.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_novo_nordisk_ozempic_wegovy_jpg_786cdf3b34.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_8805_JPG_6768aaedc3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_brian_armstrong_coinbase_2_jpg_59a44ebea9.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2213364581_jpg_86d1ff954e.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_cathiewood_OG_jpg_a3c8fddb3f.webp)