Advertisement|Remove ads.

GM Retail Investors Caught Between Recall Woes And China Restructuring Buzz

General Motors (GM) is recalling certain 2023-2024 Cadillac LYRIQ all-wheel drive vehicles, according to the National Highway Traffic Safety Administration (NHTSA). The agency said the anti-lock brake system (ABS) of the vehicles may activate unexpectedly and release brake pressure in the vehicle's service brake system.

A release of brake pressure can cause a loss of braking ability, increasing the risk of a crash, it explained.

The NHTSA further notified that the electronic brake control module software will be updated through an over-the-air update or by a dealer, free of charge. According to the agency, owner notification letters are expected to be mailed September 23. The potential number of units affected amounts to 21,469. Reuters had earlier reported the story.

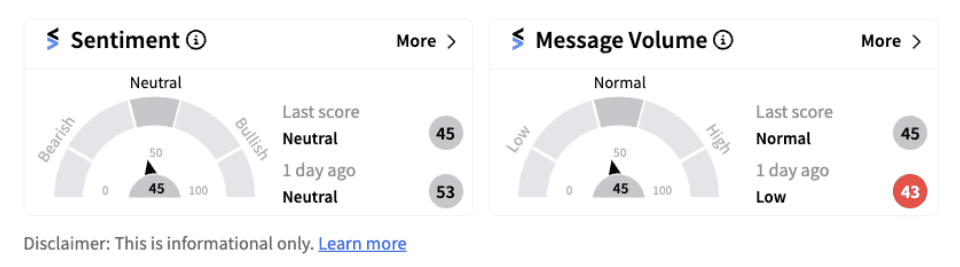

Following the development, retail sentiment on Stocktwits continued to trend in the ‘neutral’ territory (45/100) but inched-down from yesterday’s score of (53/100).

The negative news appeared to have been offset by reports that the firm is busy conducting an overhaul in China.

On Monday, Bloomberg reported that the auto-major has been cutting jobs in China and is set to meet its local partner SAIC to work out a larger restructuring of its operations. The report further stated that the lay-offs are happening in market-related departments that include research and development.

The company is now reportedly focussing on producing electric vehicles and upscale models while trimming factory capacity.

Recently, CFO Paul Jacobson reportedly said at an auto conference that he doesn’t necessarily accept the notion that the firm is struggling to make money there. However, second-quarter earnings tell a different story. GM reported China equity loss of $104 million during the quarter-ended June 30, 2024, compared to a profit of $78 million in the same quarter a year ago.

Retail investors remain undecided on the fate of the stock as they digest both the reports. However, a much-awaited restructuring of the firm’s Chinese operations appears to have provided some optimism to investors regarding the company’s long-term prospects.

/filters:format(webp)https://news.stocktwits-cdn.com/large_stock_chart_falling_resized_jpg_c0ce61eff2.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Rounak_Author_Image_7607005b05.png)

/filters:format(webp)https://news.stocktwits-cdn.com/large_MSTR_caaa0be909.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1903197985_jpg_2c45018acb.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/shivani_photo_jpg_dd6e01afa4.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Trending_stock_resized_may_jpg_bc23339ae7.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2203138957_jpg_dd735f9905.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/vivekkrishnanphotography_58_jpg_0e45f66a62.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_lumen_technologies_logo_resized_jpg_29f9980341.webp)