Advertisement|Remove ads.

Gold Prices Notch Another Record High On Simmering US-China Tensions, Rate Cut Prospects

Gold prices rose to hit another all-time high on Thursday as trade tensions between the U.S. and China showed no signs of slowing down amid expectations of a rate cut by the Federal Reserve.

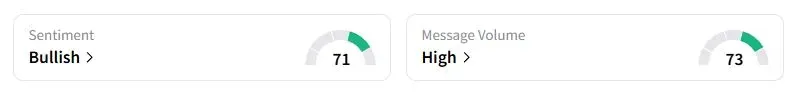

Spot gold prices rose as high as $4.241.9 per ounce, before giving back some of the gains. Retail sentiment on Stocktwits about the SPDR Gold Shares ETF (GLD) was in the ‘extremely bullish’ territory at the time of writing.

What’s Driving The Record-breaking Run?

Bullion’s recent surge has been driven by the escalation of trade tensions between the U.S. and China after Beijing imposed curbs on rare earth exports last week. The two sides then slapped fees on ships originating from each other, before Trump threatened a 100% tariff hike on all Chinese goods.

U.S. Treasury Secretary Bessent said on Wednesday that the U.S. could take further actions, including export controls, if Beijing took retaliatory measures and was also ready to impose tariffs on China over its purchases of Russian oil, if European allies agreed to do the same.

Separately, Federal Reserve Chair Jerome Powell said earlier this week that the U.S. central bank will decide on interest rates on a case-by-case basis before also noting that economic conditions have not changed materially since the Fed’s last meeting, where it cut rates by 25 basis points. According to CME Group’s FedWatch tool, an overwhelming majority of traders expect cuts of similar levels in the next two meetings of Fed policymakers.

“A reescalation in U.S.-China trade tensions has driven this week’s safe-haven demand, compounding a perfect storm of other tailwinds, surging geopolitical risks in Europe, ballooning fiscal debt concerns, and voracious buying from central and private investors,” IG analyst Tony Sycamore said.

How has gold fared this year compared to Equities and Bitcoin?

The bullion has gained over 60% this year, heading toward its best yearly gains since 1979. The S&P 500 has gained 13.6% this year, while Bitcoin is up 19.3%. The sharp rise had led to strong flows into gold ETFs. The holdings of the SPDR Gold Trust, the largest gold-backed ETF, rose to 1,022.60 tons on Wednesday, their highest since July 2022.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Circle_Internet_jpg_add0182c9c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2263898051_jpg_9e75888009.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2262920033_jpg_f596c67fd3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1227710498_jpg_fbb12d04bf.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2233918556_jpg_1c5248e175.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2227669377_jpg_9a115c3623.webp)