Advertisement|Remove ads.

Goldman Sachs Advises 'Sell' For Decker, Crocs Stocks: Retail Sentiment Divided

Goldman Sachs has initiated coverage on footwear companies Deckers Outdoor (DECK) and Crocs (CROX), citing limited upside due to the increasing competition and changing market dynamics these companies face.

The brokerage set a $90 price target for DECK and a $88 price target for CROX, implying approximately 15% and 18% downside, respectively.

Deckers was the worst-performing consumer sector stock in the first half of 2025, with shares falling about 50%. Crocs shares are down 2.6% year-to-date.

Deckers, which sells Hoka running shoes and Ugg boots, has potential for international growth but faces accelerating competition, particularly in the running category, which is slowing momentum for the brand, Goldman Sachs said in an investor note.

Consequently, the research firm views a less attractive risk-reward scenario in the near term compared to other companies in the apparel and accessories sector.

For Crocs, while the analyst is constructive on its differentiated marketing and innovation capabilities, but believes the demand for the classic clog shoes could temper and limit the pace of international expansion.

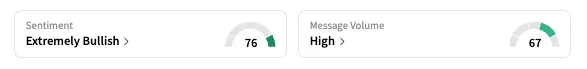

On Stocktwits, the retail sentiment was 'extremely bullish' for Deckers and 'neutral' for Crocs.

The optimism for Deckers was likely fueled after the U.S. and Vietnam, a key manufacturing site for the shoe company, struck a trade deal to lower tariff duties.

Goldman Sachs also initiated coverage on athleticwear brand Under Armour (UA) with a ‘neutral’ rating. On the broader market, it noted that the slowdown in Nike’s business has opened shelf space and market‑share opportunities for rivals.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Rigetti_resized_jpg_4e393f1208.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_8805_JPG_6768aaedc3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_robinhood_bitcoin_OG_jpg_fbd13fff2e.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_4530_jpeg_a09abb56e6.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_iren_OG_jpg_ba842dd11a.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/IMG_9209_1_d9c1acde92.jpeg)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2240705652_jpg_64172b74f3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Trade_Desk_jpg_e7ed8e2266.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_wall_street_bull_OG_jpg_791f8f3b40.webp)