Advertisement|Remove ads.

Deckers Is Worst S&P 500 Loser In H1 As Hoka Shoes Lose Their Kick

Deckers Outdoor (DECK) had a dream run the last couple of years, as its Hoka shoes became a hit with consumers seeking fresh designs and capabilities. However, the U.S. tariffs and their impact on the market trends all but torched it.

Deckers lost half of its market value in the first six months of 2025, the steepest drop for a stock in the S&P 500, according to Finviz data. In recent months, analysts have become concerned that Hoka shoes are losing their appeal as consumers are spending less or reverting to their standard Nikes.

It started with Deckers' third-quarter earnings in February. Despite the expectation-beating performance and bumped-up guidance, the stock tumbled over 20% the day after the earnings release, as management stated it was running low on inventory.

February was also when President Donald Trump indicated that he was working on a plan to raise tariffs on all trading partners, in a significant blow to companies like Deckers, which primarily manufactures and imports its shoes from Southeast Asia.

Deckers' valuation crashed from an all-time high of $33.2 billion on January 31 to $15.4 billion as of the last reading. As retail brands navigated the situation, the actual tariff announcement in early April confirmed that the business disruption would be worse than expected.

In May, Deckers said it expects an additional $150 million in costs for its fiscal year 2026, but did not provide a complete forecast. Meanwhile, its Q4 results fell short, while Hoka's quarterly sales grew the least among the year.

After those results, Wells Fargo said that while the story is still "OK," the decelerating revenue trajectory creates an arduous setup, and Bank of America called Hoka's growth trajectory clouded.

The loss of momentum also shows that consumers are no longer going for challenger brands, a new trend that has disrupted companies like Under Armour (UAA) and Lululemon (LULU).

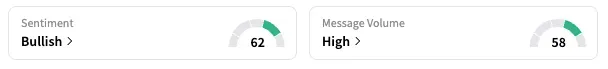

On Stocktwits, the retail sentiment for Deckers was 'bullish' as of early Tuesday.

A user said they got back to wearing Nike shoes after they saw Hoka being priced higher.

Deckers' shares are down 50.4% year-to-date, compared to the 5.5% gain in the benchmark S&P 500 index (SPX).

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/astspacemobile_resized_jpg_8a6aa92413.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2231279747_jpg_9150b71435.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2250929484_jpg_8206df84ab.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2263849665_jpg_4d6eff48f1.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_1247400381_jpg_765e6ec016.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_janetyellen_resized_jpg_ea2c28f284.webp)