Advertisement|Remove ads.

Goldman Sachs Warns Risks Of A Drawdown Are Rising As US Equities Climb To Fresh Record Highs: Report

- The firm’s analysts said their Risk Appetite Indicator has fallen to 0.2, down from the “Goldilocks” zone they were in earlier in the year.

- They state that the odds of a sell-off in the equity markets are higher than those of a large rally.

Goldman Sachs analysts on Friday reportedly warned that the risks of a drawdown are rising as U.S. equities scale new record highs.

According to a CNBC report citing a recent Goldman Sachs note, the firm’s analysts said their Risk Appetite Indicator has fallen to 0.2, down from the “Goldilocks” zone they were in earlier in the year.

Earlier on Friday, the Dow Jones Industrial Average soared to a new record high of 47,326.73, the S&P 500 index rose to 6,806.42, while the Nasdaq Composite touched 23,248.

Sell-off Odds Higher

Goldman Sachs analysts are optimistic that the U.S. economic growth will reaccelerate in 2026. However, they stated that the odds of a sell-off in the equity markets are higher than those of a large rally, according to the report.

“The pick-up in drawdown risk has been driven by elevated equity valuations and a weak U.S. business cycle. Our equity asymmetry framework suggests that the probability of a sell-off is higher than that of a large rally,” the analysts said in the note, according to the report.

U.S. equities gained in Friday’s regular trading session after the CPI report for September showed consumer prices rose less than expected during the month.

According to data from the Bureau of Labor Statistics (BLS), CPI rose 0.3% in September on a seasonally adjusted basis. On an annualized basis, CPI was at 3% before the seasonal adjustment.

Contrarian Take

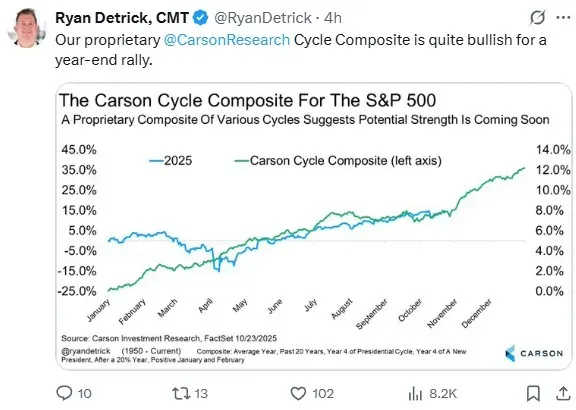

In contrast, Ryan Detrick, Chief Market Strategist at Carson Group, stated in a post on X that he is bullish on a year-end rally in the S&P 500 index.

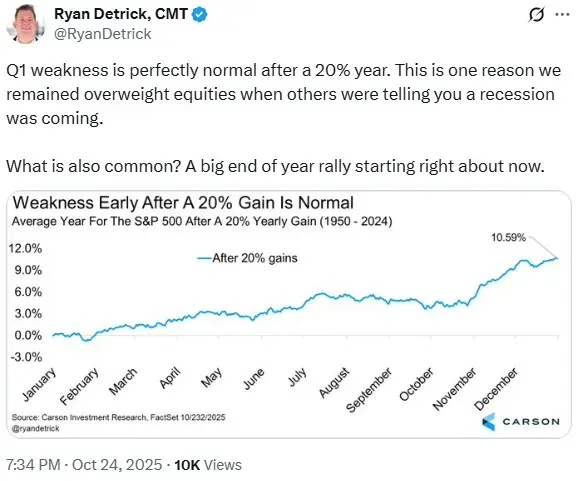

He added in another post that weakness in the first quarter (Q1) following a 20% bull run is “perfectly normal.”

“This is one reason we remained overweight equities when others were telling you a recession was coming. What is also common? A big end of year rally starting right about now.”

— Ryan Detrick, Chief Market Strategist, Carson Group

Meanwhile, U.S. equities gained in Friday’s midday trade. At the time of writing, the SPDR S&P 500 ETF (SPY), which tracks the S&P 500 index, was up 0.92%, the Invesco QQQ Trust ETF (QQQ) gained 1.21%, while the SPDR Dow Jones Industrial Average ETF Trust (DIA) rose 1.1%. Retail sentiment around the S&P 500 ETF on Stocktwits was in the ‘bearish’ territory.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_microstrategy_michael_saylor_resized_9fd19e69ec.jpg)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2262651778_jpg_54075aa1d9.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/IMG_9209_1_d9c1acde92.jpeg)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_ibm_signage_mwc_resized_28f91e1a63.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_circle_stablecoins_original_jpg_b238d12be8.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_US_stocks_3e2253bcca.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/Revised_Profile_JPG_0e0afdf5e2.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2209881066_jpg_ebc4b9b217.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_4530_jpeg_a09abb56e6.webp)