Advertisement|Remove ads.

GrafTech International Stock Rises Pre-Market After Q4 Loss Narrows, Revenue Tops Estimates: Retail Stays Skeptical

Graphite electrodes and petroleum coke manufacturer GrafTech International (EAF) shares rose nearly 3% in Friday’s pre-market session after its fourth-quarter loss fell in line with Wall Street estimates while revenue topped expectations.

Net sales fell 2% year-over-year (YoY) to $134.217 million compared to a Wall Street expectation of $129 million. Adjusted loss per share matched estimates at $0.13. Net income for the quarter narrowed to $49.48 million compared to $217.41 million in the same quarter a year ago.

The quarter also saw sales volume rise 13% compared to the fourth quarter of 2023.

CEO Timothy Flanagan said with the successful completion of the previously announced financing transactions, the firm ended the year with $464 million of liquidity, which will support its ability to manage through the near-term, industry-wide challenges.

Flanagan also highlighted that the pricing environment remains unsustainably low as graphite electrode demand remains muted and competitive pressures persist in many key regions.

“As a result, we are taking further actions to accelerate our path to normalized levels of profitability and support our ability to invest in our business. These include initiatives to optimize our order book and actively shift the geographic mix of our business to regions where there is an opportunity to capture higher average selling prices,” he said.

“In addition, we have informed our customers of our intention to increase prices by 15% on volume that is not yet committed for 2025,” the CEO added.

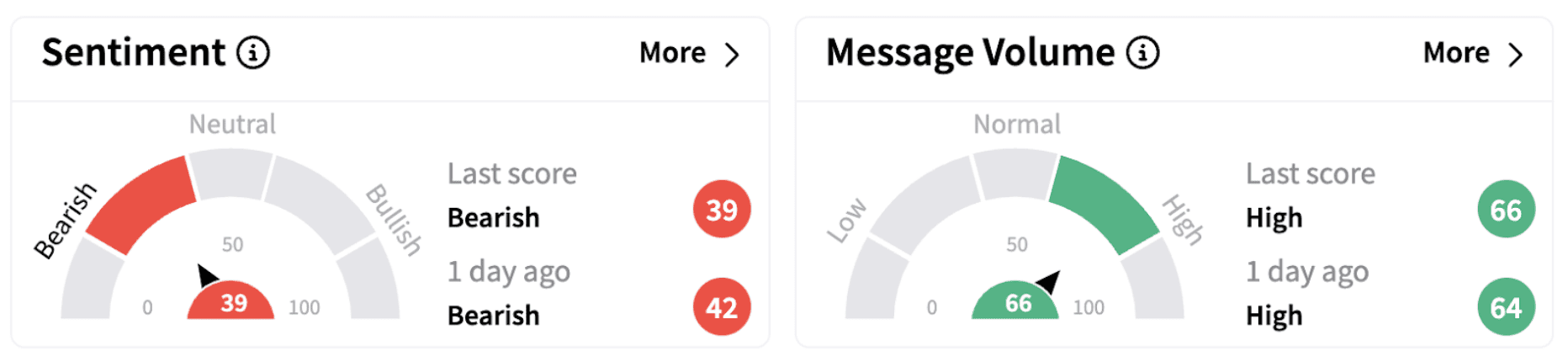

On Stocktwits, retail sentiment dipped further into the ‘bearish’ territory (39/100) accompanied by ‘high’ message volume.

EAF shares have lost over 13% in 2025 but are up over 11% over the past year.

Also See: Bank Stocks Rally After Federal Reserve Releases 2025 Stress Test Parameters With Smaller Shocks

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_140648412_jpg_05552b4117.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_912727778_jpg_3bd44c57ad.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1235943608_jpg_91702ef0ab.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_167578473_jpg_29255f031f.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Michael_Burry_jpg_fa0de6ac92.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_winklevoss_1c7de389e0.webp)