Advertisement|Remove ads.

Bank Stocks Rally After Federal Reserve Releases 2025 Stress Test Parameters With Smaller Shocks

U.S. bank stocks rallied Thursday after the Federal Reserve announced hypothetical scenarios for its 2025 annual stress test that indicated smaller shocks to the economy.

According to the new scenario, the U.S. unemployment rate rises nearly 5.9 percentage points to a peak of 10%. At the same time, unemployment rate increase is accompanied by severe market volatility, a widening of corporate bond spreads, and a collapse in asset prices, including about a 33% decline in house prices and a 30% decline in commercial real estate prices.

According to a CNBC report, Jason Goldberg of Barclays believes the 2025 scenario has smaller spikes in unemployment and smaller declines in stock and real estate values compared to the previous versions.

The Federal Reserve also reiterated its plans to take steps soon to reduce the volatility of stress test results and begin to improve model transparency in the 2025 stress test.

The CNBC report also quoted Bank of America analyst Ebrahim Poonawala as saying banks could hold smaller capital cushions later this year, with the test being less challenging and more predictable.

“The 2025 stress test scenario, broadly better vs last year, increases our confidence that banks should begin to see relief on regulatory capital requirements, given our expectations for a shift to a balanced, transparent, and more predictable regulatory regime,” Poonawala wrote in a note.

The Federal Reserve Board also released two hypothetical elements designed to probe different risks through its "exploratory analysis" of the banking system. It said this would not affect bank capital requirements.

Following the development, shares of Bank of America Corp (BAC), JPMorgan Chase & Co (JPM), Morgan Stanley (MS), Goldman Sachs Group Inc (GS), and their peers rallied between 1% and 2.5% on Thursday.

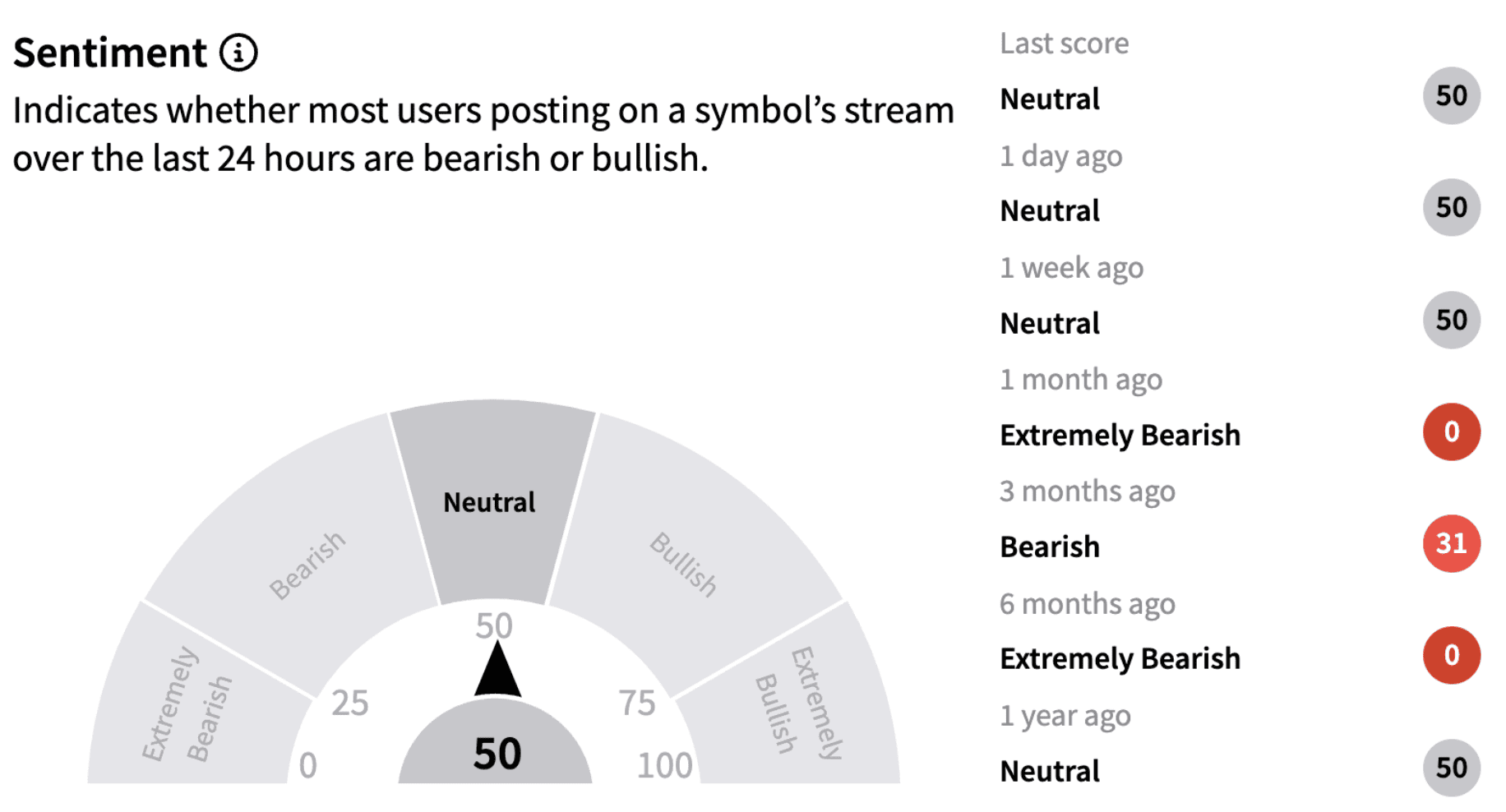

The Vanguard Financials Index Fund ETF (VFH) closed 0.75% higher on Thursday. On Stocktwits, retail sentiment continued to trend in the ‘neutral’ territory (50/100).

VFH has gained nearly 8% in 2025 and has risen over 34% over the past year.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_hims_stock_logo_resized_jpg_5554a2a2c1.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Rounak_Author_Image_7607005b05.png)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Oil_drill_06147e8349.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/vivekkrishnanphotography_58_jpg_0e45f66a62.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2229019709_jpg_f82a27a246.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_eric_trump_OG_jpg_19bc149869.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1005541622_jpg_8079d8d434.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_immunitybio_jpg_eb6402d336.webp)