Advertisement|Remove ads.

Graphjet Stock Rockets 36% After CEO Says Company Expects To Benefit From $16.5B Tesla-Samsung Deal: Retail Wants To Buy More

Graphjet Technology (GTI) stock surged nearly 36% on Monday after the firm’s CEO said it expects to benefit from the expansion in U.S. semiconductor manufacturing, including the recent Tesla-Samsung deal. A crucial Nasdaq listing continuation order also appears to have lifted investor sentiment.

CEO Chris Lai said that the firm stands to benefit from the expansion of AI chip production as graphite and graphene, which it produces, play a crucial role in semiconductor manufacturing.

“The current growth in semiconductor industry in the United States is timely for our planned expansion to build a production plant in Nevada. We have started to generate revenue and have been gaining increasing interest in our product, with growing number of visits by corporate representatives and directors of multinational clients, requests for samples, and more qualification process,” he said.

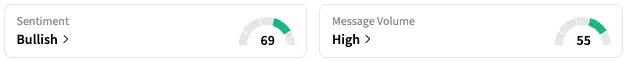

On Stocktwits, retail sentiment around GTI jumped from ‘neutral’ to ‘bullish’ territory over the past 24 hours while message volume rose from ‘low’ to ‘high’ levels.

Graphjet noted that manufacturers, including Taiwan Semiconductor Manufacturing Company (TSMC), have been expanding their production capacity in the U.S. to meet the surging demand for specialized chips, especially AI chips.

Samsung announced on Sunday that it has secured a chipmaking contract with a global company, which will run through the end of 2033.

Tesla CEO Elon Musk confirmed late Sunday that his EV company is the big customer behind Samsung Electronics’ 22.8 trillion won ($16.5 billion) semiconductor manufacturing agreement.

Samsung’s fabrication plant in Texas will be dedicated to making the next-generation AI6 inference chips, which are designed for humanoid robots, self-driving cars, and AI data centers, Musk added.

Meanwhile, Graphjet also stated that Nasdaq has granted its request to continue its listing on the bourse, provided that it fulfills certain conditions. These include demonstrating compliance with Nasdaq Listing Rules and providing a Nasdaq hearings panel with an update on its fundraising plans by September 30.

A Stocktwits user expressed optimism about the news, terming it “huge,” and said they will reenter their position.

However, another user sounded skeptical about the optimism surrounding the news.

GTI stock is down by about 87% this year and by about 96% over the past 12 months.

Read also: WeRide Receives Autonomous Driving Permit in Saudi Arabia: Retail Sees Stock Hitting $20

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_HPE_office_with_logo_resized_c15b2ba0d3.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_stock_market_fall_generic_jpg_f7dffafa95.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2219201937_jpg_67aaff68c1.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2213366819_jpg_3e8b649e98.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1445160636_jpg_9759816169.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_stock_price_rising_OG_jpg_5f141f956f.webp)