Advertisement|Remove ads.

Grindr Confirms Buyout Interest From Top Shareholders, Shares Jump Over 4% In After-Hours

Grindr, Inc. shares rose 4.3% in extended trading on Tuesday after the dating app company confirmed buyout interest from some of its top shareholders.

Chair James Lu and director Ray Zage sent a letter to the board expressing their intention to buy out Grindr's outstanding shares and take the company private, the company said on Tuesday. It is not a formal offer, although Grindr said it has formed a special committee of independent directors to evaluate any definitive proposal that may emerge.

Grindr is a same-sex relationships and casual dating-focused app, launched in 2009. The company’s shares were listed on the New York Stock Exchange through its merger with a special purpose acquisition company in November 2022.

Semafor first reported the deal talks on Monday, pegging the buyout price at around $15 a share, which values Grindr at $3 billion. The report stated that Lu and Zage were in talks to secure debt financing for the deal from private-equity firm Fortress Investment Group. The duo collectively owns about 70% of Grindr.

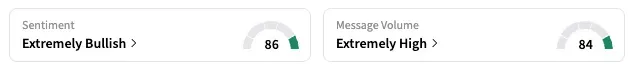

The company's shares rose 10.7% on Monday and declined 3.8% the next day, setting Grindr's market cap at $2.45 billion. On Stocktwits, the retail sentiment shifted to 'extremely bullish' as of late Tuesday, from 'bearish' the previous day.

Notably, Grindr's shares have declined 29% year-to-date amid a broader slowdown in the dating apps market.

Match Group, the parent company of Tinder and Hinge, has reported multiple quarters of a dip in paying users, while Bumble has faced challenges in growing its base of premium subscribers.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_nio_battery_swap_jpg_de98f34bea.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_sealsq_stock_market_representative_resized_b05435011f.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_anthropic_OG_jpg_51bd14bc5d.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2233516954_jpg_72241a7246.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Oil_tanker_resized_jpg_bb40d4bd7e.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_robinhood_CEO_OG_jpg_e773f9395c.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)