Advertisement|Remove ads.

Gulf Oil stays confident on FY26 outlook; rupee slide remains key drag

Manish Gangwal, Chief Financial Officer of Gulf Oil Lubricants, highlighted the strong performance of its EV subsidiary, Tirex, and said it is expected to surpass ₹100 crore in revenue in some years.

Mumbai-based Gulf Oil Lubricants India expects strong growth in FY26, even though currency movements are putting some pressure on margins. The company is confident about demand and its position in the market.

Speaking to CNBC-TV18, Chief Financial Officer Manish Gangwal said Gulf Oil continues to grow faster than the overall lubricant industry, which usually sees only slow growth. He remains positive that the company will finish the year with double-digit volumes and revenue growth.

“We grow usually 2 to 3 times, we maintain around high single digit to 10 to 12% volume growth for the year. That's what projection is for the full year,” he said.

In the July–September quarter (Q2FY26), Gulf Oil Lubricants India reported revenue of ₹966 crore, a profit of ₹84 crore, and operating margins of 12.10%.

"Crude was very stable during the quarter, but foreign exchange, the rupee depreciated sharply… and that led to an increase in the input cost," Gangwal noted, highlighting that the company imports nearly 70% of its raw materials.

While selective price increases have been implemented, he acknowledged a time lag in their full realisation.

A significant growth driver is the company's electric vehicle (EV) charging subsidiary, Tirex Transmission. Having already clocked ₹42 crore in revenue in the first half of the year, a 75% jump, the subsidiary is on a fast track. "For the year we are aiming to cross above ₹100 crore in terms of revenue for sure," Gangwal stated.

The medium-term outlook is even more ambitious, with a target of ₹300 to ₹400 crore in revenue over the next three to four years. Gulf Oil recently increased its stake in the Ahmedabad-based company to 65%.

Gangwal took a measured view on the opportunity in immersion cooling fluids for data centres. He said Gulf Oil has two products awaiting POC approval but noted that the segment will remain very small—likely under 1–2% of the overall lubricant market even at its peak.

He described it as a futuristic space, adding that India is still far from widespread adoption of liquid-cooled data centres.

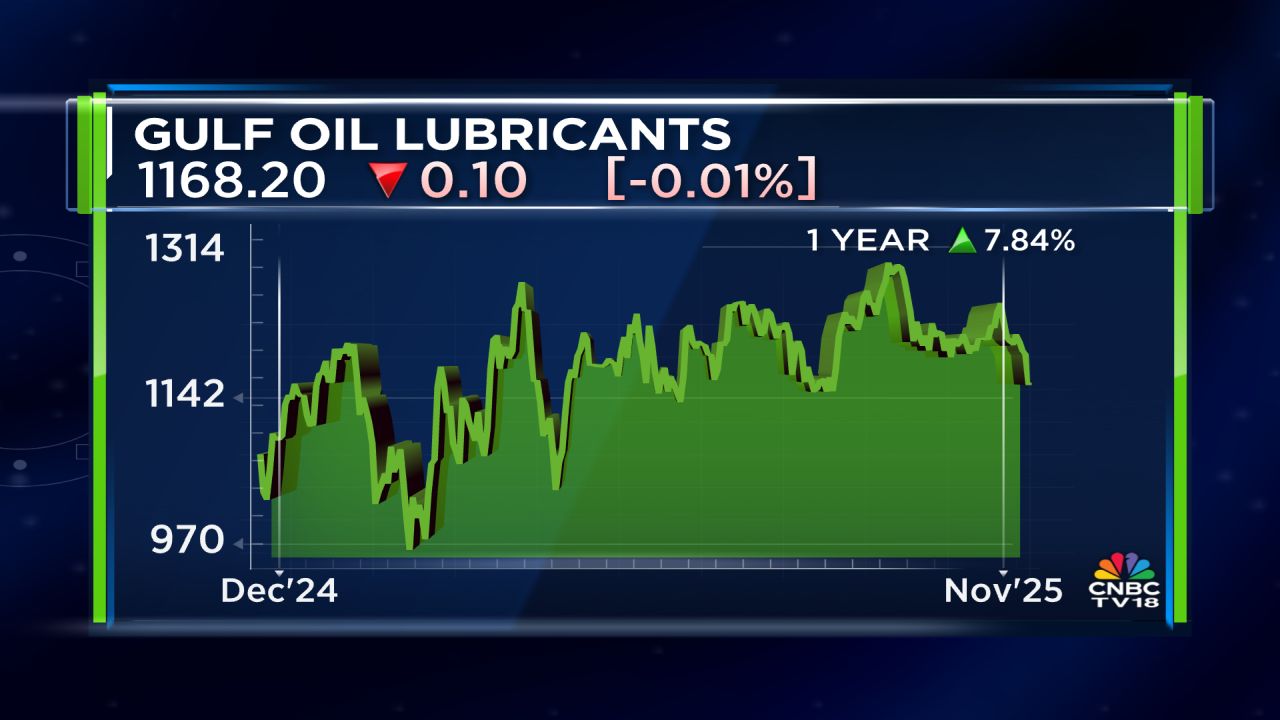

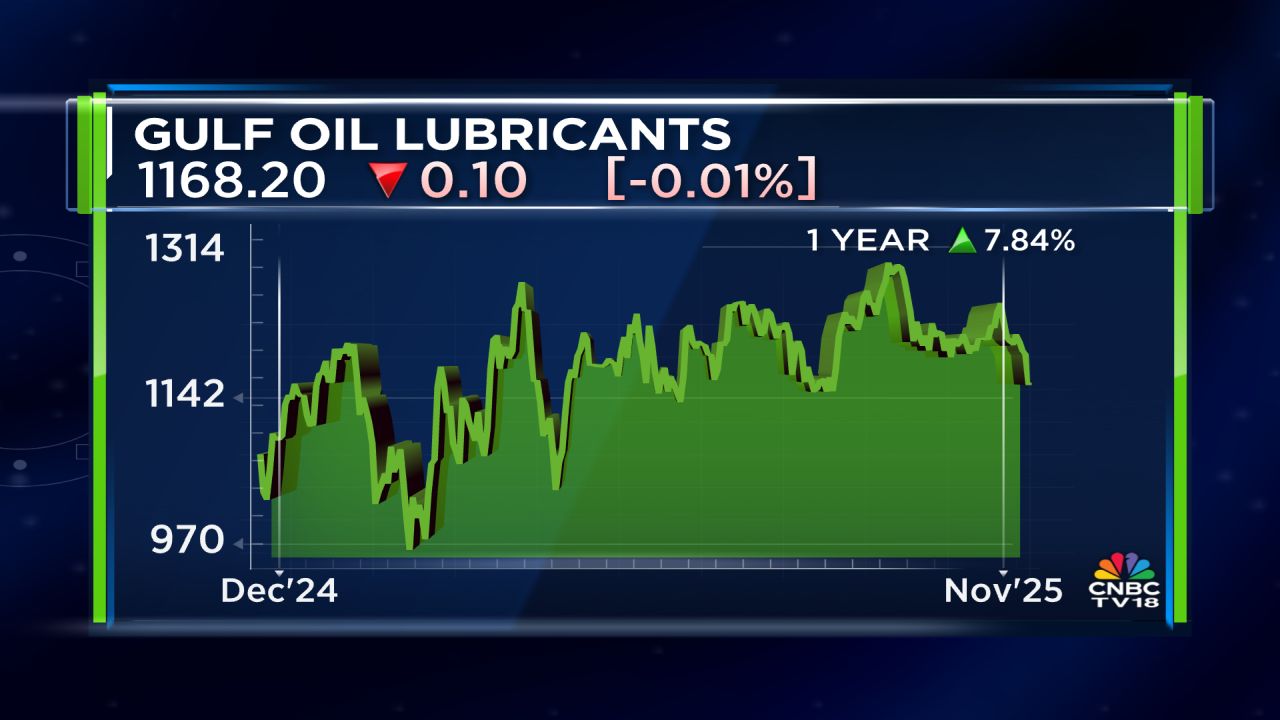

Gulf Oil Lubricants India’s current market capitalisation is ₹5,773 crore. The stock is currently trading at ₹1,170.30 as of 9:22 am on the NSE and has gained 8% over the last year.

Watch accompanying video for more

Follow our live blog for more stock market updates

Speaking to CNBC-TV18, Chief Financial Officer Manish Gangwal said Gulf Oil continues to grow faster than the overall lubricant industry, which usually sees only slow growth. He remains positive that the company will finish the year with double-digit volumes and revenue growth.

“We grow usually 2 to 3 times, we maintain around high single digit to 10 to 12% volume growth for the year. That's what projection is for the full year,” he said.

In the July–September quarter (Q2FY26), Gulf Oil Lubricants India reported revenue of ₹966 crore, a profit of ₹84 crore, and operating margins of 12.10%.

"Crude was very stable during the quarter, but foreign exchange, the rupee depreciated sharply… and that led to an increase in the input cost," Gangwal noted, highlighting that the company imports nearly 70% of its raw materials.

While selective price increases have been implemented, he acknowledged a time lag in their full realisation.

A significant growth driver is the company's electric vehicle (EV) charging subsidiary, Tirex Transmission. Having already clocked ₹42 crore in revenue in the first half of the year, a 75% jump, the subsidiary is on a fast track. "For the year we are aiming to cross above ₹100 crore in terms of revenue for sure," Gangwal stated.

The medium-term outlook is even more ambitious, with a target of ₹300 to ₹400 crore in revenue over the next three to four years. Gulf Oil recently increased its stake in the Ahmedabad-based company to 65%.

Gangwal took a measured view on the opportunity in immersion cooling fluids for data centres. He said Gulf Oil has two products awaiting POC approval but noted that the segment will remain very small—likely under 1–2% of the overall lubricant market even at its peak.

He described it as a futuristic space, adding that India is still far from widespread adoption of liquid-cooled data centres.

Gulf Oil Lubricants India’s current market capitalisation is ₹5,773 crore. The stock is currently trading at ₹1,170.30 as of 9:22 am on the NSE and has gained 8% over the last year.

Watch accompanying video for more

Follow our live blog for more stock market updates

Read about our editorial guidelines and ethics policy

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2177851471_jpg_c649cab52d.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Sourasis_Bose_Author_Image_939f0c5061.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2216312549_jpg_cd0ea4cf02.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/IMG_9209_1_d9c1acde92.jpeg)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2204154647_jpg_b295df5f6b.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/shanthi_v2_compressed_98c13b83cf.png)

/filters:format(webp)https://images.cnbctv18.com/uploads/2025/06/jaiprakash-associates-2025-06-e8d024261fcd9c97cf4ad2b87905cba1.jpeg)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/cnbctv18logo.png)

/filters:format(webp)https://images.cnbctv18.com/uploads/2025/10/2026-ktm-990-rc-r-6-2025-10-b26da165e26bf7fd01bf905b00a989ae.jpg)

/filters:format(webp)https://images.cnbctv18.com/uploads/2025/08/earnings-2025-08-d3133d86583d9a97ac2c324ea91fc5d1.jpg)