Advertisement|Remove ads.

Hawaiian Electric Q4 Earnings Miss On Higher Expenses Sends Stock Sliding: Retail’s Divided

Shares of Hawaiian Electric Industries Inc. (HE) fell 2.7% in after-market hours on Friday after the company’s fourth-quarter earnings missed Wall Street estimates by a considerable margin.

Hawaiian Electric posted earnings per share (EPS) of $0.20 in Q4, in a quarter marred by a surge in operational expenses and a loss on the sale of one of its investments. Wall Street had estimated an EPS of $0.34.

The utility company’s revenue also fell during the quarter, falling to $799.18 million from $853.42 million a year ago.

For 2024, Hawaiian Electric’s EPS stood at $0.98, falling from $1.38 a year ago. Data from FinChat shows the company was expected to post an EPS of $1.74 in 2024.

Operational expenses rose during the quarter and fiscal year 2024, affecting the company’s net income throughout the year.

Some of these expenses were related to prevention measures established by the company in light of the Maui wildfires in 2023. The company has also made progress in the tort litigations brought against it, noting that it has reached definitive settlement agreements.

According to The Fly, analysts at Jefferies called the Supreme Court’s decision in the wildfire case a “win” for Hawaiian Electric, noting that it improves visibility in finalizing the $4 billion settlement.

The brokerage maintained a ‘Hold’ rating on the stock, with a price target of $10 – nearly 5% lower than HE’s closing price on Friday.

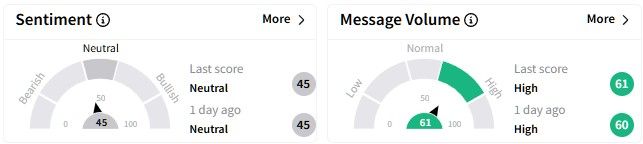

On Stocktwits, retail sentiment around the Hawaiian Electric stock showed caution among investors – it hovered in the ‘neutral’ (45/100) territory, even as message volume was at ‘high’ levels.

Hawaiian Electric’s stock has declined over 7.5% in the past six months, but its one-year returns are worse, with a fall of over 15%.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

Also See: Okta Stock Gets A Price Target Hike At Barclays Ahead Of Q4 Earnings: Retail Feels Bullish

/filters:format(webp)https://news.stocktwits-cdn.com/large_crypto_atm_OG_jpg_ab7e4567eb.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2228372233_jpg_0ab0e02ff6.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/IMG_9209_1_d9c1acde92.jpeg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1903197985_jpg_2c45018acb.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_8805_JPG_6768aaedc3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_bitcoin_2026_jpg_f51342601b.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2194622714_jpg_c18475d557.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_china_stocks_jpg_80a255b8ac.webp)