Advertisement|Remove ads.

Okta Stock Gets A Price Target Hike At Barclays Ahead Of Q4 Earnings: Retail Feels Bullish

Shares of Okta Inc. (OKTA) will be in focus as markets open on Friday. Analysts at Barclays hiked their price target for the stock ahead of the company’s fourth-quarter earnings.

Okta, a San Francisco-based identity and access management service provider, will post its Q4 results on March 3 during after-market hours.

Wall Street estimates peg Okta’s earnings per share (EPS) at $0.74 during Q4, falling from $0.63 that the company reported in the same period last year.

Revenue is expected to surge to nearly $669 million during the quarter, rising over 11% year-on-year (YoY).

Okta has beaten analyst estimates on earnings and revenue fronts in all the previous four quarters.

Analysts across brokerages have expressed optimism about the company’s prospects as it approaches its Q4 results announcement.

According to The Fly, Barclays hiked its price target for the Okta stock to $105 from $96, implying an upside of more than 10% from Thursday’s close. The brokerage has an ‘Equal Weight’ rating on the stock.

It sees an upside in Q4, with pending performance obligations estimated at $2.2 billion. This, it says, balances the company's mixed channel checks and order seasonality.

Analysts at KeyBanc recently hiked their price target for the Okta stock to $125 from $115, implying an upside of more than 31% from current levels.

Underscoring its bull thesis for Okta, KeyBanc said in its latest note that the company’s fourth-quarter checks were vigorous and improved from prior quarters.

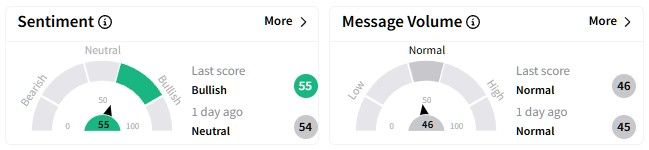

On Stocktwits, retail sentiment around the Okta stock was in the ‘bullish’ (56/100) territory at the time of writing, while message volume was at ‘normal’ levels.

Data from FinChat shows that the average price target for Okta stock is $105.17. Of the 40 brokerages with recommendations, data shows 13 have a ‘Buy’ rating on the stock, eight have an ‘Outperform’ rating, and 18 recommend ‘Hold.’

Okta stock has fallen by almost 3% in the past six months, while its one-year performance is relatively better, with gains of over 17%.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

Also See: Constellium Stock Edges Lower On Weak Outlook For 2025 After A Mixed Q4: Retail Sentiment Declines

/filters:format(webp)https://news.stocktwits-cdn.com/large_Vanda_jpg_943c16fa4f.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_8805_JPG_6768aaedc3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_brian_armstrong_OG_jpg_3ac8291bf2.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_donald_trump_jpg_39d73f48c3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2212776621_jpg_54c763cf43.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/IMG_9209_1_d9c1acde92.jpeg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2226079120_jpg_10ed2924af.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_4530_jpeg_a09abb56e6.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_bitcoin_OG_oct23_jpg_588046d0a9.webp)