Advertisement|Remove ads.

HCL Tech Approaches Key Resistance: SEBI RA Sees Bullish Setup Ahead Of Q1 Earnings

HCL Technologies’ shares remained under pressure on Monday. The global tech company is set to announce its first-quarter (Q1 FY26) earnings next week on July 14.

Brokerages are expecting yet another soft quarter from the IT services sector, driven by continued weakness in the demand environment. Antique Stock Broking forecasts that HCL Technologies is likely to maintain its FY26 revenue growth guidance of 2%–5% in constant currency terms.

On its daily chart, SEBI-registered analyst Deepak Pal noted that the stock is consistently holding strong support near its 14-day Exponential Moving Average (EMA), while also approaching minor resistance near the 200-day moving average (DMA), reflecting sustained buying interest.

Both daily and weekly charts indicate that the stock is trading within a healthy positive trend. Fundamentally, he believes HCL Technologies remains sound, and for the past month, the stock has been firmly holding above the ₹1,650 level, trading within a tight range.

On the weekly timeframe, HCL Tech continues to trade within an upward trajectory, with a clear range between ₹1,750 on the upside and ₹1,675 on the downside. The overall trend and structure remain bullish, supported by strong technical indicators, he added.

From a trading perspective, Pal advised that any dip toward ₹1,650 can be considered as a favorable buying opportunity, with a stop-loss below ₹1,650. On the upside, the stock has the potential to test ₹1,775 in the near term.

Meanwhile, Financial Independence suggested selling HCL Tech only below ₹1,705 (cash levels) in the options market.

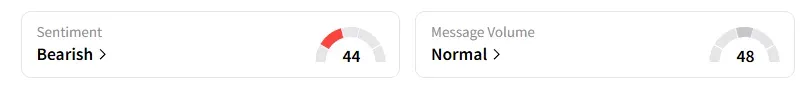

Data on Stocktwits shows that retail sentiment is ‘bearish’ since June on the counter.

HCL Tech shares have fallen 10% year-to-date (YTD).

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_adam_smigielski_K5m_Pt_O_Nmp_HM_unsplash_f365ee93f4.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_trump_jpg_fc59d30bbe.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1190665957_jpg_92088206ed.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2235337192_jpg_56c00409cf.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_marvell_logo_OG_jpg_dfc748dd9b.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2232147590_jpg_a31aecbfad.webp)