Advertisement|Remove ads.

HCL Technologies Shares Surge Over 6% As Investors Cheer Earnings, Guidance

Investors are gung-ho about HCL Technologies, following its fourth-quarter earnings and guidance commentary.

The stock gained 7% in early session on Wednesday, driven by the company's strong deal wins and guidance, which is considered better than its peers.

India’s third-largest IT company posted a consolidated net profit of ₹4,307 crore for the March quarter, up 8.1% year-on-year.

Revenue rose 6.1% to ₹30,245 crore, impacted by persistent weakness in discretionary tech spending across key markets.

Operating margins were stable at 18%, compared to 17.6% a year earlier.

For FY26, HCL Tech expects revenue to grow between 2%-5% in constant currency terms. Margins are expected to remain in the 18%-19% range.

The company reported deal wins worth $3 billion for the quarter.

CEO C Vijayakumar said the company delivered a strong finish to the fiscal year and remains focused on building next-gen offerings around AI and automation.

“Our pipeline continues to be healthy, and we are confident in our ability to drive growth despite the current macro uncertainties,” he said in a statement.

The board also declared an interim dividend of ₹18 per share.

JPMorgan upgraded HCL to ‘Overweight’ with a price target of ₹1,750, representing an 18% upside. With a dividend yield of 4% and 6% free cash flow (FCF) yield, JPM sees strong value in the stock.

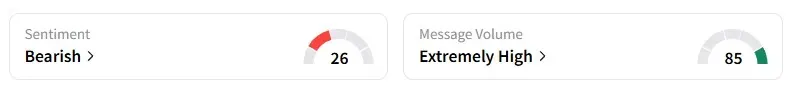

Data from Stocktwits indicates retail sentiment has reduced to ‘bearish' from ‘extremely bearish’ a week ago, while message volume was ‘high.’

HCL Tech is down 17% year-to-date (YTD).

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1813801150_jpg_9e452258fa.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2190302521_jpg_796f64970e.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2194612888_1_jpg_5f7b7f6186.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1384896168_jpg_87fab3f04d.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2263571605_jpg_f769289486.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2233719278_jpg_46dfac21ee.webp)